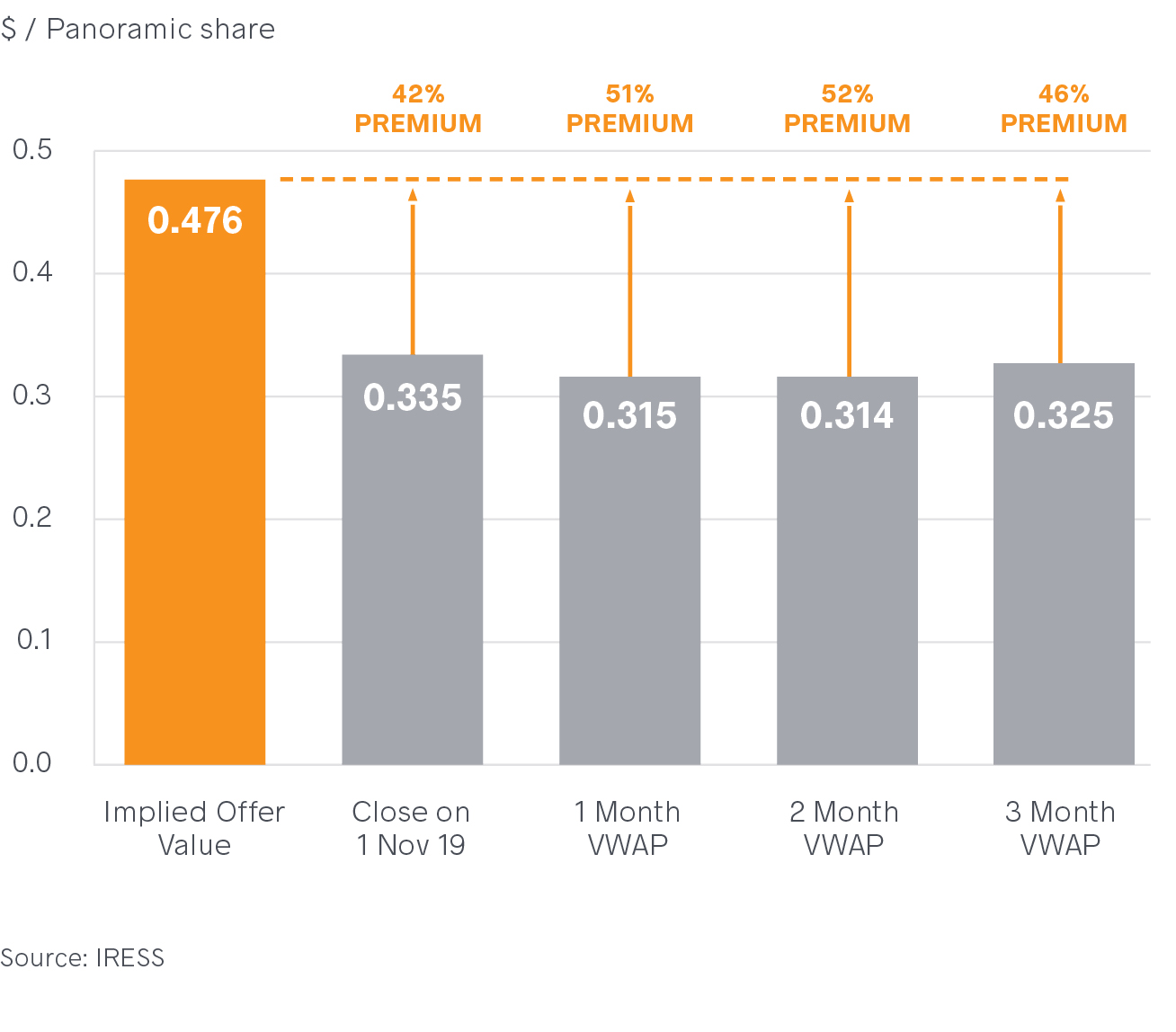

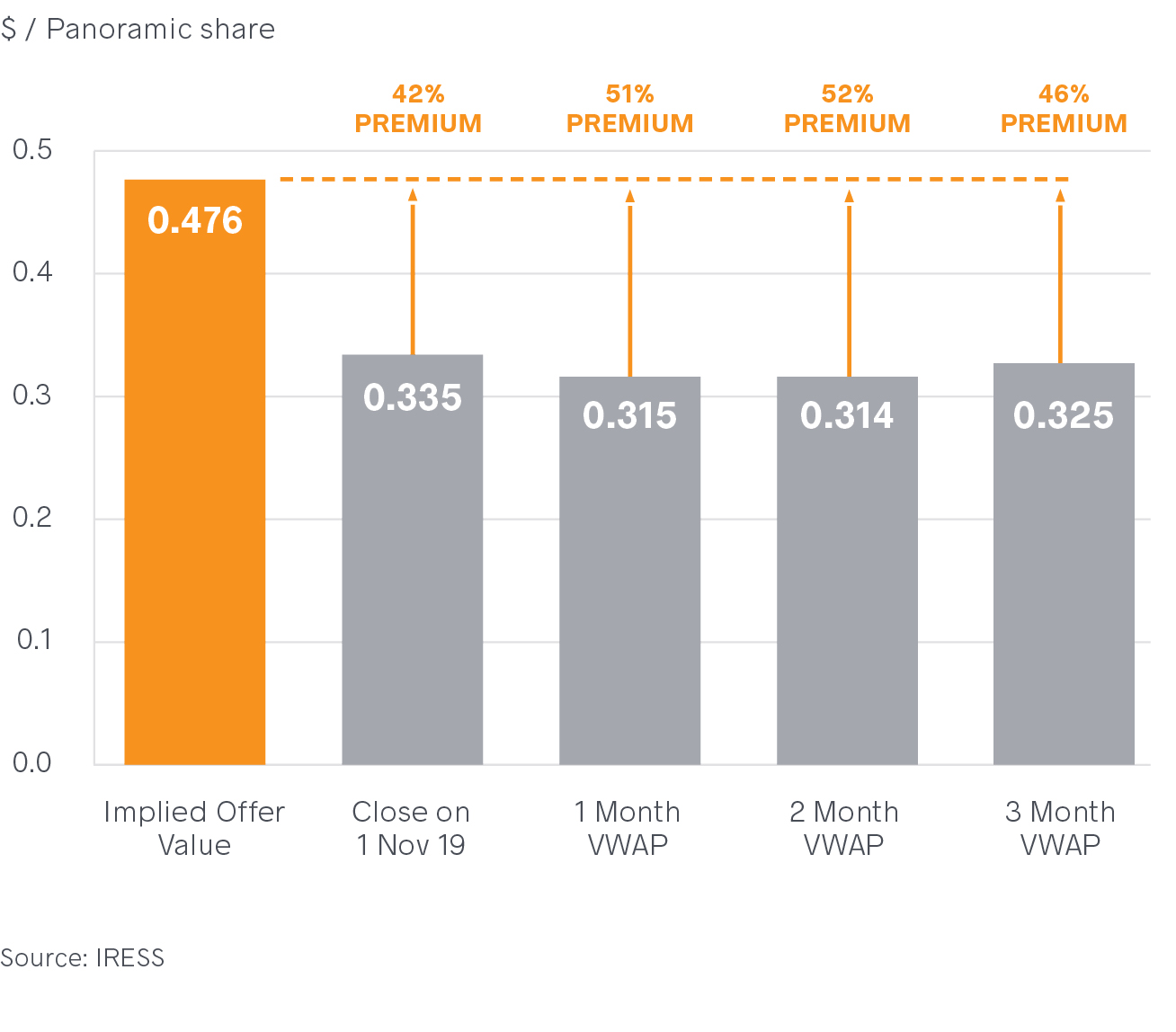

The implied Offer value of $0.4761 represents a very attractive and significant premium of:

• 42% to the closing price of Panoramic Shares on 1 November 2019, being the last trading day before 4 November 2019 (Announcement Date);

• 51% to the 1-month VWAP of Panoramic Shares up to and including 1 November 2019;2

• 52% to the 2-month VWAP of Panoramic Shares up to and including 1 November 2019;2 and

• 46% to the 3-month VWAP of Panoramic Shares up to and including 1 November 2019.2

Panoramic Shares have not traded at the implied Offer value of $0.476 per Panoramic Share since 1 March 2019, prior to Panoramic’s first equity raising of this year announced on 11 March 2019. IGO’s Offer represents, in IGO’s view, a rare opportunity for Panoramic Shareholders to realise a very attractive and

significant premium for their Panoramic Shares.

Panoramic Shareholders who acquired shares at $0.28 per share through the pro-rata renounceable entitlement offer announced on 5 September 2019 will, if they ACCEPT the Offer, realise a premium of 70%3 on those shares.

1. Based on the 1 month VWAP of IGO Shares up to and including 1 November 2019, being the last trading day before the Announcement Date.

2. Calculated up to and including 1 November 2019, based on the cumulative value traded on ASX and CHI-X divided by cumulative volume traded on ASX and CHI-X.

3. Assumes an implied offer price of $0.476 per Panoramic Share.