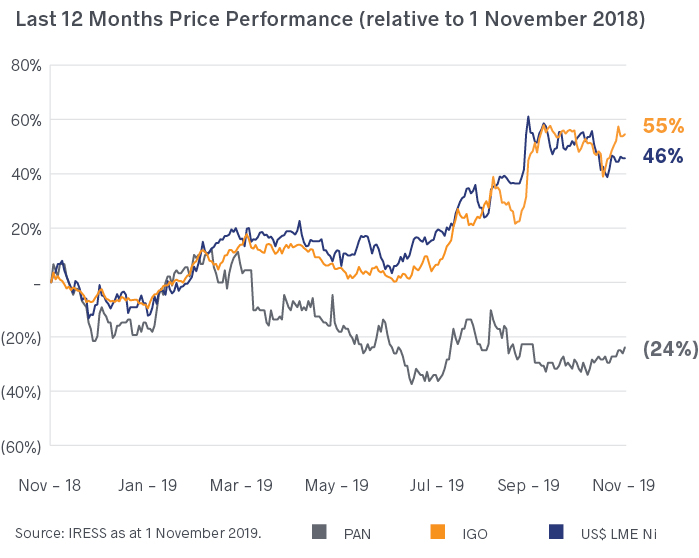

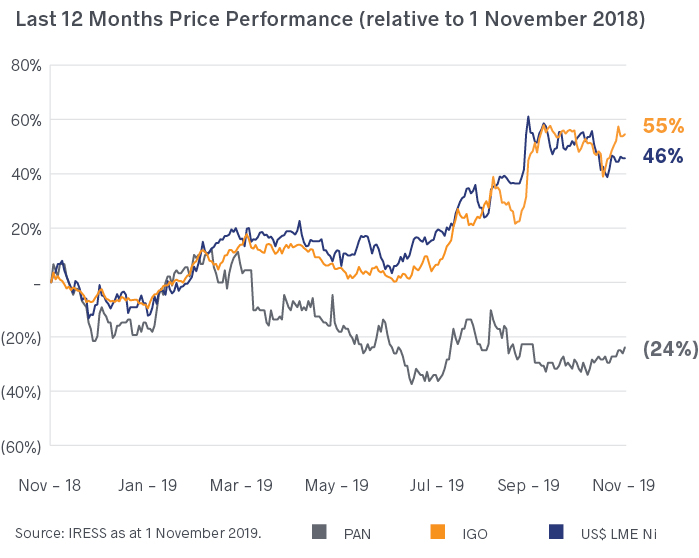

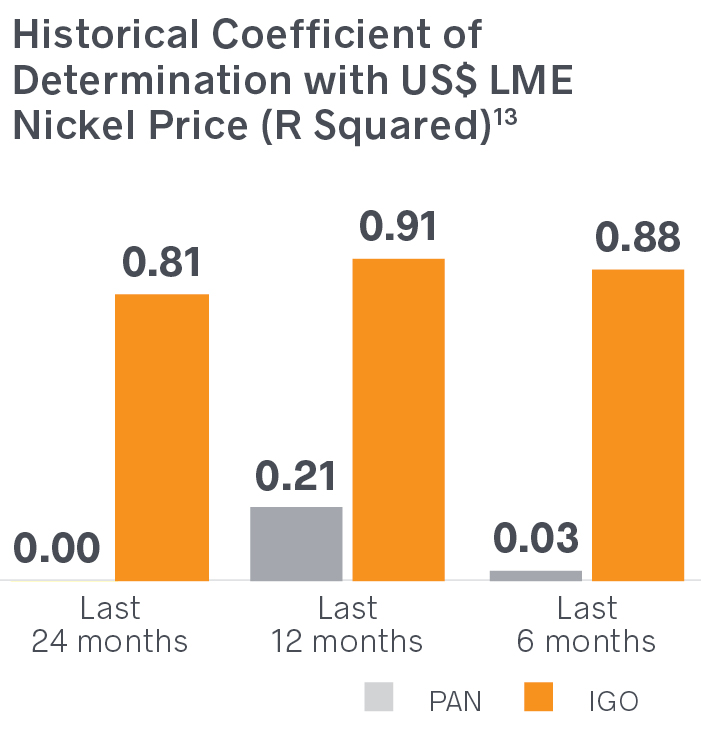

In combination with the exposure accepting Panoramic Shareholders would have to the attractive, world class Nova operation and the Savannah operation, accepting Panoramic Shareholders would enjoy superior leverage to the nickel price (based on historical performance). Based on analysis of historical movements between the nickel price and share prices, IGO believes that a share in IGO is more likely than a share in Panoramic to benefit from a rising nickel price. The relative relationship of IGO and Panoramic’s share prices to the US dollar nickel price is demonstrated below.

IGO’s share price has historically demonstrated a stronger correlation to movements in the nickel price than Panoramic’s share price.

Source: IRESS as at 1 November 2019.

13. As at close of trading 1 November 2019. The strength of the relationship between the share price of both Panoramic and IGO with the nickel price is measured by the coefficient of determination, also referred to as ‘R Squared’. The coefficient of determination is a measure of the proportion of variance in a dependent variable that is predictable from an independent variable. The closer the measure is to one, the stronger the observed relationship between the variables.