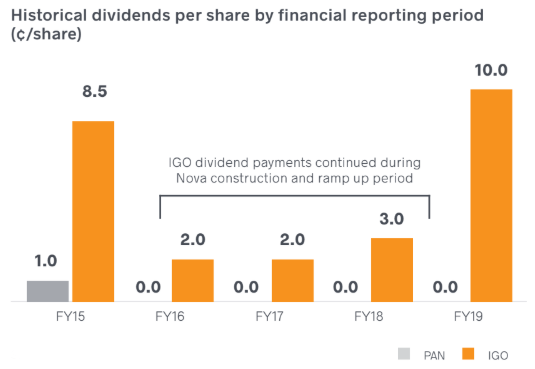

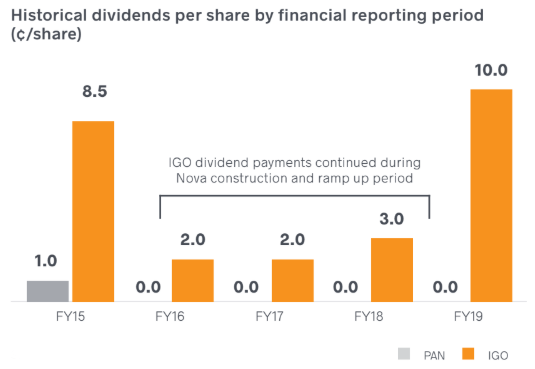

In FY19, the IGO Board adopted a shareholder returns policy which targets the return of 15% to 25% of free cash flow (ie net cash flow from operating activities less cash outflow from investing activities) to shareholders via dividends and/or share buybacks. This was changed from a “net profit after tax” based dividend policy under which IGO paid cash dividends every year since 2004 (including during the ramp up of Nova and during periods of low nickel price). The total dividends paid by IGO in respect of FY19 pursuant to its shareholder returns policy was 10 cents per share.

By comparison, Panoramic has not paid a dividend to its shareholders since 2015. Instead, Panoramic has asked shareholders to contribute additional capital to the company twice in 2019 alone, raising approximately $50.6 million before costs in new funds during Savannah’s ramp-up. A comparison of

historical dividends per share is presented in the chart below.

Additionally, it is not known whether Panoramic will call for further capital from shareholders while it continues its efforts to resolve challenges at Savannah or address the concerns of its lender (the Savannah Financing Agreement has been amended twice in 2019). With both asset and corporate level constraints,

it is not clear when Panoramic Shareholders will receive future dividends.

Source: IRESS