NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

110 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

Other information

This section of the notes includes other information that must be disclosed to comply with the accounting standards and

other pronouncements, but are not considered critical in understanding the financial performance or position of the

Group.

26 Share-based payments

The Group provides benefits to employees (including executive directors) of the Group through share-based incentives.

Information relating to these schemes is set out below.

(a) Employee Performance Rights Plan

The Independence Group NL Employee Performance Rights Plan (PRP) was approved by shareholders at the Annual

General Meeting of the Company in November 2014. Under the PRP, participants are granted share rights which will

only vest if certain performance conditions are met and the employees are still employed by the Group at the end of the

vesting period. Participation in the PRP is at the Board’s discretion and no individual has a contractual right to

participate in the plan or to receive any guaranteed benefits.

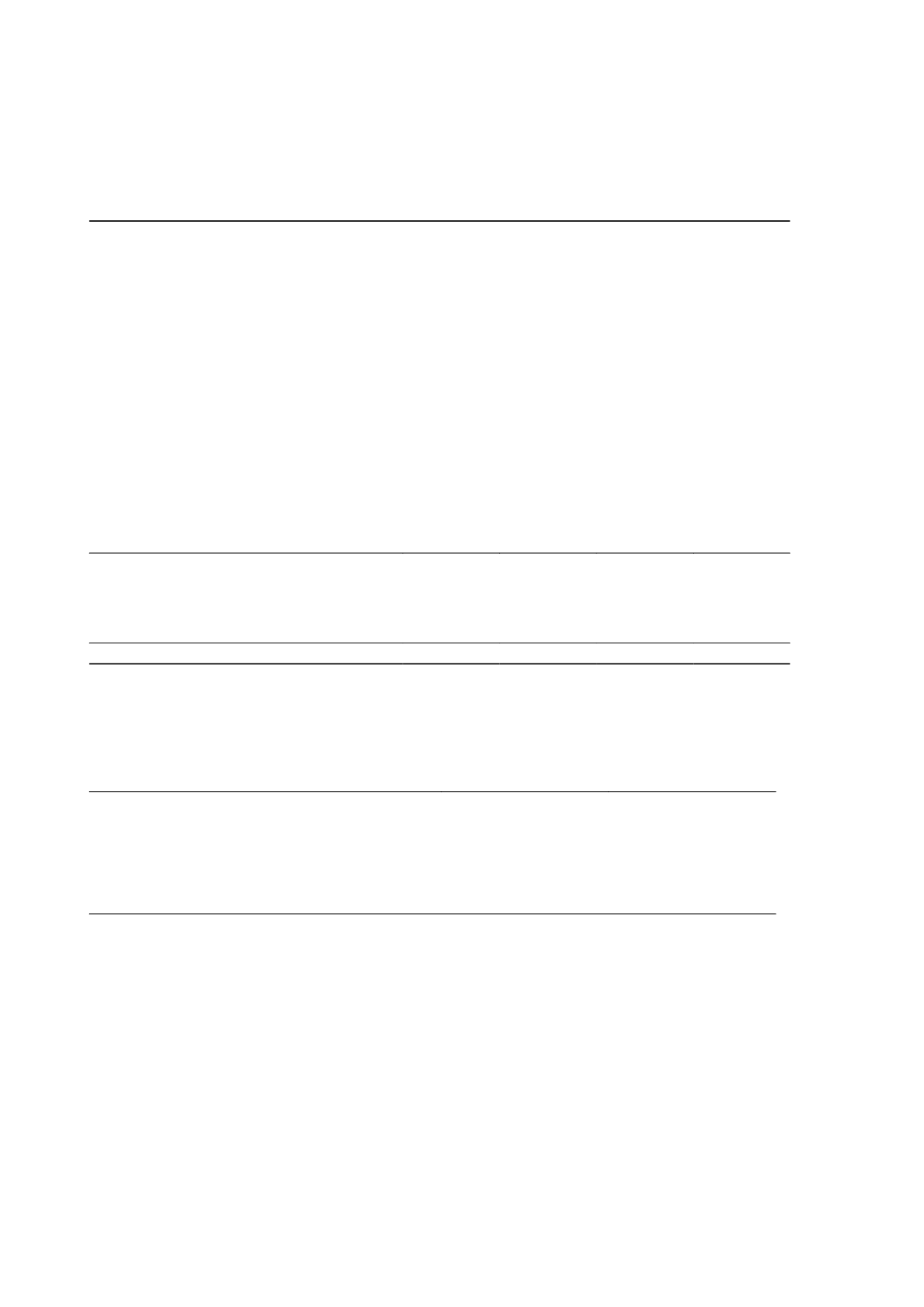

(b) Equity settled awards outstanding

2016

2015

Number of

share rights

Weighted

average fair

value

Number of

share rights

Weighted

average fair

value

Outstanding at the beginning of the year

2,313,757

2.85

3,255,175

2.99

Rights issued during the year

643,911

1.32

509,480

2.65

Rights vested during the year

(1,323,613)

3.19

(932,668)

3.00

Rights lapsed during the year

(258,903)

2.23

(518,230)

3.23

Rights cancelled during the year

(23,029)

2.41

-

-

Outstanding at the end of the year

1,352,123

1.91

2,313,757

2.85

(c) Fair value of share rights granted

The fair value of the share rights granted during the year ended 30 June 2016 are determined using a trinomial tree

which has been adopted by the Boyle and Law (1994) node alignment algorithm to improve accuracy, with the following

inputs:

Fair value inputs

CEO

Other senior management

Grant date

16 December 2015

22 January 2016

Vesting date

1 July 2018

1 July 2018

Share price at grant date

$2.20

$2.11

Fair value estimate at grant date

$1.56

$1.20

Expected share price volatility (%)

47

48

Expected dividend yield (%)

1.14

1.14

Expected risk-free rate (%)

2.14

1.94

The share-based payments expense included in profit or loss for the year totalled $819,000 (2015: $2,949,000).

(d) Employee share scheme

Share rights granted after 1 July 2014

Vesting of the performance rights granted to executive directors and executives after 1 July 2014 is based on a total

shareholder return (TSR) scorecard. The TSR scorecard for the three year measurement period will be determined

based on a percentile ranking of the Company's TSR results relative to the TSR of each of the companies in the peer

group over the same three year measurement period.

The peer group is to comprise the constituents of the S&P ASX 300 Metals and Mining Index who are engaged in gold

and/or based metals mining in Australia and have the closest market capitalisation to the Company.

Independence Group NL

82