Annual Report 2016 37

DIRECTORS’ REPORT

Directors' report

30 June 2016

(continued)

Operating and financial review (continued)

Operations (continued)

Long Operation (continued)

The Long Operation constitutes an operating segment as disclosed in the Financial Report. During the year a total of

215,337t of ore was mined, sourced from Moran (93%), Long Lower (3%), McLeay (2%) and Victor South (2%). The

majority of ore continued to be mined from long hole stoping (91%) with lesser amounts coming from other mechanised

mining methods and non-mechanised methods.

Total segment revenue decreased by 43% during 2016, driven predominantly by a 34% lower realised AUD nickel price

together with 16% lower payable nickel tonnes sold. In addition, the restructure that was implemented in September

2015 resulted in the discontinuation of a number of mining methods at the Long Operation, resulting in lower, though

more profitable, sales volumes.

Based on current ore reserves, the mine currently has a life of approximately 1.5 years.

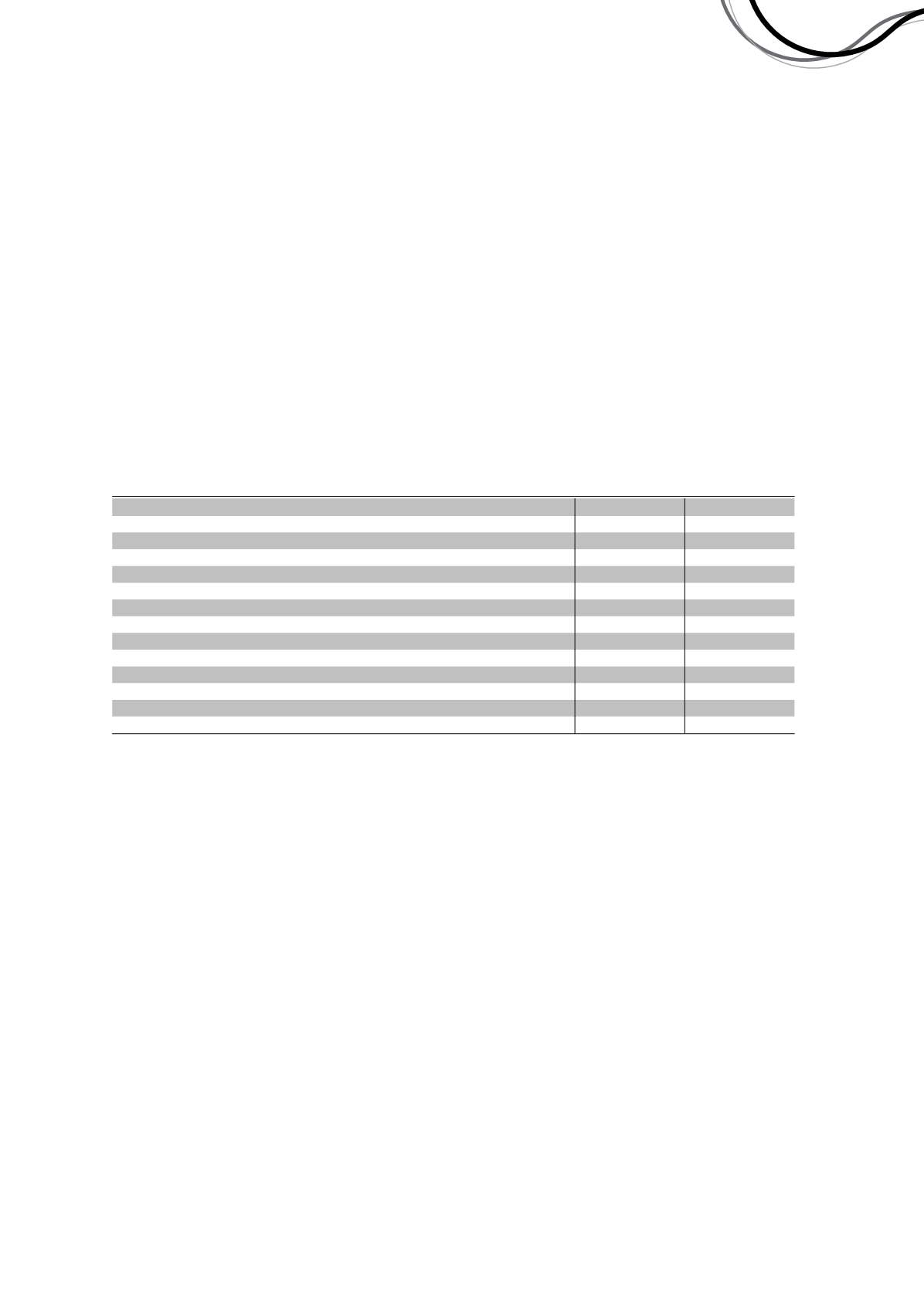

The table below highlights the key results and operational statistics during the current and prior year.

Long Operation

2016

2015

Total revenue

$'000

63,926

111,423

Segment operating (loss) profit before tax

$'000

(3,532)

32,110

Total segment assets

$'000

65,738

92,546

Total segment liabilities

$'000

35,200

36,180

Ore mined

tonnes

215,337

258,634

Nickel grade

head %

3.94

3.94

Copper grade

head %

0.28

0.28

Tonnes milled

tonnes

215,337

258,634

Nickel delivered

tonnes

8,493

10,198

Copper delivered

tonnes

610

723

Metal payable (IGO share)

- Nickel

tonnes

5,125

6,151

- Copper

tonnes

247

293

Ni cash costs and royalties

A$ per pound of payable metal

3.67

4.01

* Cash costs include credits for copper

Jaguar Operation

The Jaguar Operation was acquired by the Company in 2011 through the acquisition of Jabiru Metals Limited. The

Operation is located 60km north of Leonora and 300km north of Kalgoorlie. All ore is currently mined from the Bentley

underground mine, located 6km south of the Jaguar processing facility, which is used to beneficiate the ore mined to

produce zinc and copper concentrates. These concentrates are trucked to the Geraldton port for shipping to customers

primarily in Asia. The copper concentrate contains significant levels of silver and gold as by-products, which attract

precious metal credits that contribute significantly to the Group’s cash flows and revenue. The zinc concentrate has

minor amounts of silver in its concentrate.

In addition, both near mine and greenfields exploration targets continue to be investigated for potential to add mine life

to the operation. Two potential areas are projects known as the ‘Bentley deeps', beneath the existing Bentley

underground mine, and Triumph, located 6km north of the Jaguar processing facility. Both projects continued to be

targeted in the 2016 financial year for drilling, once completed they will be further evaluated.

The performance of the Bentley underground mine outperformed the previous year; ore mined increased by 3% and ore

milled increased by 4%. Copper grades were constant at 1.8% while zinc grades mined fell 1.6% to 8.9%. This variation

in run of mine grades is due to the variable nature of the geology and the stopes scheduled for mining. Both reserves

and resources are reconciling well.

Copper and zinc concentrate sales are paid on a quotational period that varies between one and four months, with

generally 90% of the sales receipt payable by the customer shortly after shipment. The one month or four month

average LME copper and zinc price ultimately determines the final price paid by the customer.

Independence Group NL

8