38 Independence Group NL

DIRECTORS’ REPORT

Directors' report

30 June 2016

(continued)

Operating and financial review (continued)

Cash outflows from investing activities increased during the year to $423.5 million, primarily due to the cash payment for

the acquisition of Sirius ($202.1 million, net of cash acquired) and payments towards the construction of the Nova

Project ($179.5 million). Other movements comprised $10.6 million for capitalised exploration expenditure and $10.7

million associated with acquisition of property, plant and equipment, primarily driven by Tropicana improvement work

aimed at delivering higher plant throughput. The Group also realised $16.0 million from the sale of its investment in Gold

Road Resources Ltd.

On 16 July 2015, the Company entered into a new Syndicated Facility Agreement (Facility Agreement) with National

Australia Bank Limited, Australia and New Zealand Banking Group Limited and Commonwealth Bank of Australia

Limited for a $550 million committed term finance facility on an unsecured basis. The Facility Agreement comprises a

five year $350 million amortising term loan facility that was used to refinance Sirius' existing Nova Project finance

facility, and provide funds for the continued development, construction and operation of the Nova Project; and a five

year $200 million revolving loan facility that was used to partially fund the payment of the cash component of the

Acquisition Scheme and transaction costs, in addition to providing funding for general corporate purposes.

Cash flows from financing activities during the financial year predominantly comprised drawdowns from the debt facility,

which totalled $271.0 million for the period. In addition, the Group paid $12.8 million in dividends during the year. Total

cash flows relating to capitalised transaction costs associated with the Facility Agreement were $5.3 million. These

costs are incremental costs that are directly attributable to the Facility Agreement and include loan origination fees, legal

fees and other costs relating to the establishment of the loan.

During discussions of the operating results of its business, the Group’s Board and management monitor a measure

known as Underlying EBITDA. The Board considers this measure to be important to the Group and investors alike, as it

represents a useful proxy to measuring an operation’s cash generating capabilities. Underlying EBITDA is calculated as

profit after tax adjusted for income tax expense, finance costs, interest income, asset impairments, depreciation and

amortisation. Underlying EBITDA decreased relative to the previous financial year as can be seen in the following chart:

Net profit/(loss) after tax (NPAT) for the year was a loss of $58.8 million compared to a profit of $76.8 million in the

previous financial year. The current year loss includes $65.1 million of acquisition and related integration costs relating

to the acquisition of Sirius, $35.5 million of impairments of capitalised exploration costs (primarily Stockman Project) and

$19.7 million of exploration expenditure. The chart below outlines the key drivers of the results for FY16 compared to

the prior corresponding year.

Independence Group NL

5

Directors' report

30 June 2016

(continued)

Operating and financial review (continued)

Operations (continued)

Jaguar Operation (continued)

Based on current ore reserves, the Bentley underground mine is currently anticipated to have a life of approximately 3.5

years.

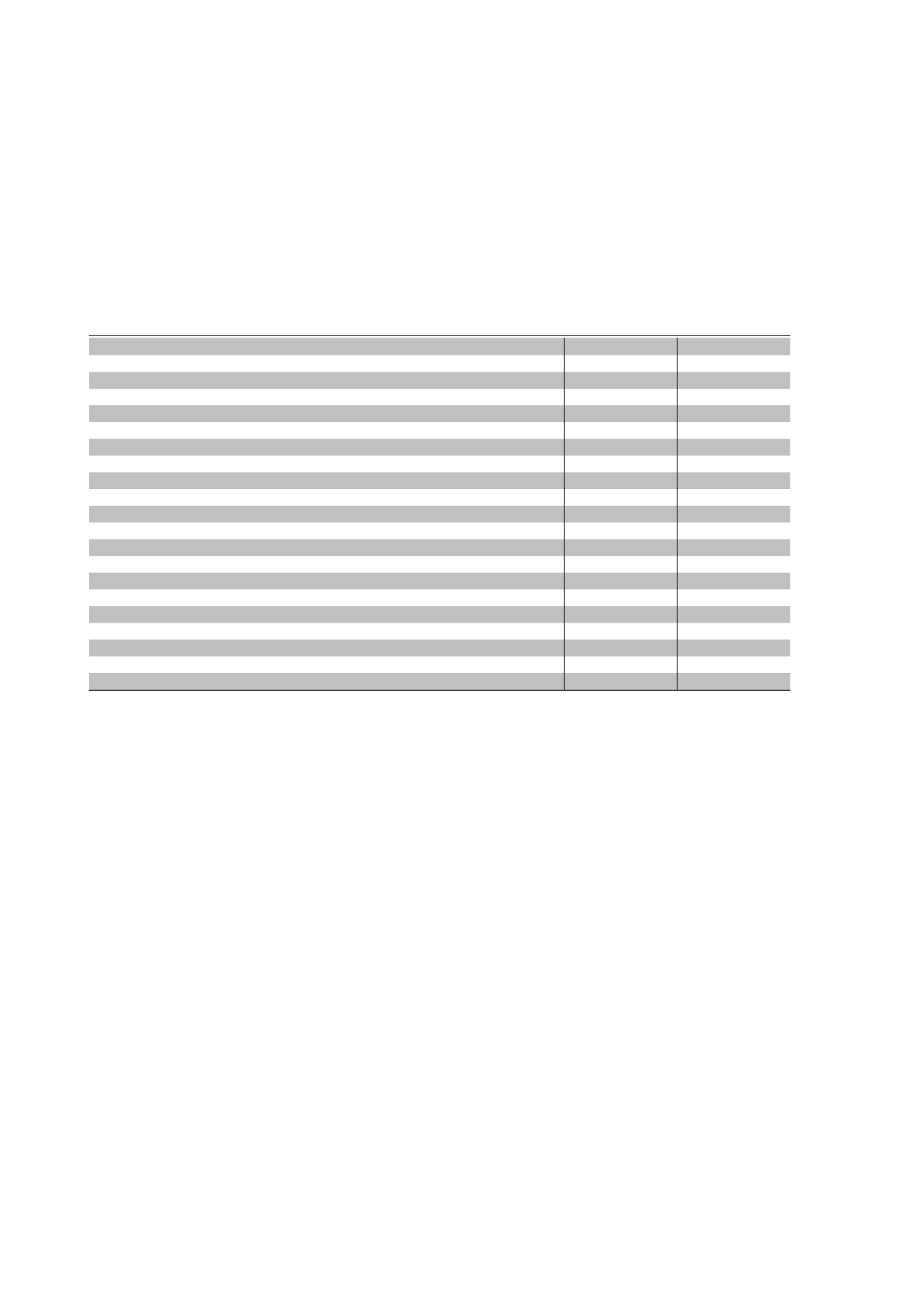

The table below outlines the key results and operational statistics during the current and prior year.

Jaguar Operation

2016

2015

Total revenue

$'000

132,987

164,016

Segment operating profit before tax

$'000

17,317

47,585

Total segment assets

$'000

145,892

134,569

Total segment liabilities

$'000

22,816

24,374

Ore mined

tonnes

497,751

485,302

Copper grade

%

1.7

1.8

Zinc grade

%

8.9

10.6

Silver grade

g/t

128

156

Gold grade

g/t

0.75

0.7

Ore milled

tonnes

505,578

488,466

Metal in concentrate

- Copper

tonnes

7,412

7,380

- Zinc

tonnes

39,335

44,999

- Silver

ounces

1,603,565

1,876,384

- Gold

ounces

4,880

4,439

Metal payable (IGO share)

- Copper

tonnes

7,122

7,090

- Zinc

tonnes

32,634

37,551

- Silver

ounces

1,071,989

1,293,858

- Gold

ounces

4,543

4,110

Zinc cash costs and royalties*

A$/lb total Zn metal produced

0.53

0.43

*Cash costs include credits for copper, silver and gold

The Jaguar Operation also constitutes an operating segment. Segment revenue decreased by 19% during FY16, with

the main drivers of this result being a decrease in zinc revenue of 27% and copper revenue of 20%. This was due to a

combination of 13% lower payable zinc sold and 9% lower realised prices. Copper revenue decreased due to 18%

lower realised prices.

External factors affecting the Group's results

The Group operates in an uncertain economic environment and its performance is dependent upon the result of inexact

and incomplete information. As a consequence, the Group’s Board and management monitor these uncertainties and

mitigate the associated risk of adverse outcomes where possible. The following external factors are all capable of

having a material adverse effect on the business and will affect the prospects of the Group for future financial years.

Commodity prices

The Group’s operating revenues are sourced from the sale of base metals and precious metals that are priced by the

LME. The Group is not a price maker with respect to the metals it sells and it is, and will remain, susceptible to adverse

price movements. The Company took advantage of strong gold price appreciation and hedged additional gold

production during and after the year-end to further de-risk future cash flow during the expected term of the repayment of

the debt used primarily for construction of the Nova Project. Hedging in FY17, FY18 and FY19 represents approximately

70%, 50% and 40% respectively of the Company's share of forecast annual gold production. The average realised gold

price achieved in FY16 was A$1,576/oz.

During the period, the Company initiated diesel hedging in order to benefit from historically low oil prices. As at

year-end, the Company had hedged 25% of expected diesel usage for the next two years.

Independence Group NL

9