NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

78 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

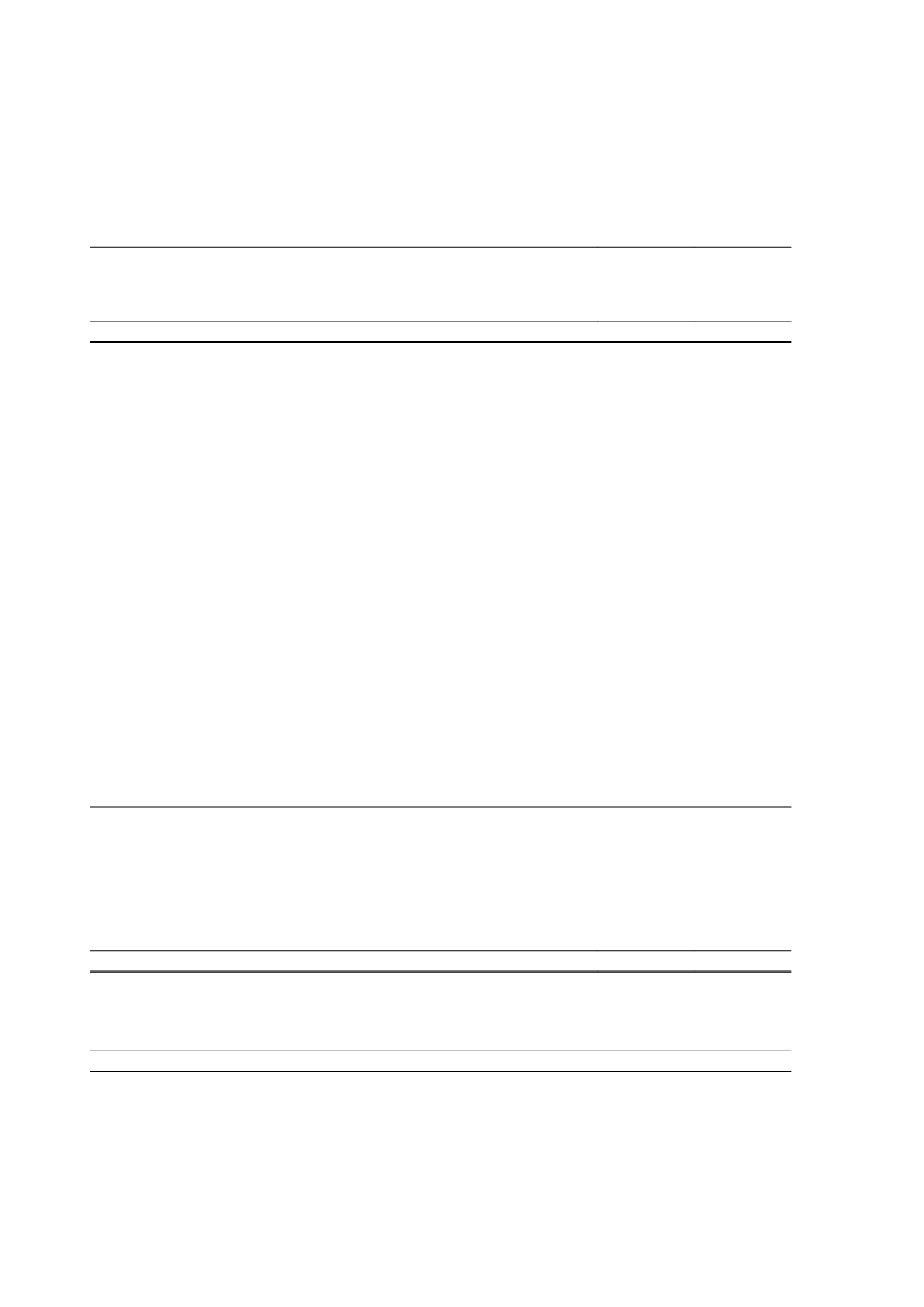

8 Trade and other receivables

2016

$'000

2015

$'000

Trade receivables

21,561

13,481

GST Receivable

3,804

1,924

Sundry debtors

2,741

3,442

Prepayments

2,794

3,239

30,900

22,086

No balances within trade and other receivables contain impaired assets. The balance of trade receivables includes

amounts of $1,448,000 (2015: $nil) that are past due but not impaired.

(a) Change in accounting policy

The Group has early adopted AASB 9

Financial Instruments

(AASB 9) with effect from 1 July 2015. AASB 9 introduces

a new impairment model for financial assets at amortised cost (including trade receivables). The new model did not

have a material impact on the Group's assessment of its doubtful debt provision for the 2016 financial year which was

assessed as $nil.

(b) Recognition and measurement

(i)

Trade receivables

Trade receivables are generally received up to four months after the shipment date. The receivables are initially

recognised at fair value.

Trade receivables are subsequently revalued by the marking-to-market of open sales. The Group determines

mark-to-market prices using forward prices at each period end for copper and zinc concentrates and nickel ore.

(ii)

Impairment of trade receivables

Collectibility of trade receivables is reviewed on an ongoing basis. Individual debts that are known to be uncollectible

are written off when identified. An allowance is made for doubtful debts based on credit losses expected over the life of

the trade receivable taking into account information about past events, current conditions and forecasts of further

economic conditions. On confirmation that the trade receivable will not be collectible, the gross carrying value of the

asset is written off against the associated provision.

9 Inventories

2016

$'000

2015

$'000

Current

Mine spares and stores - at cost

16,368

16,103

ROM inventory - at cost

19,513

9,670

Concentrate inventory - at cost

7,058

4,726

Concentrate inventory - at net realisable value

-

5,696

Work in progress - gold in process

1,175

881

Gold in circuit

1,145

798

Gold dore

1,239

2,424

46,498

40,298

Non-current

ROM inventory - at cost

31,995

24,979

31,995

24,979

Independence Group NL

50