NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

80 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

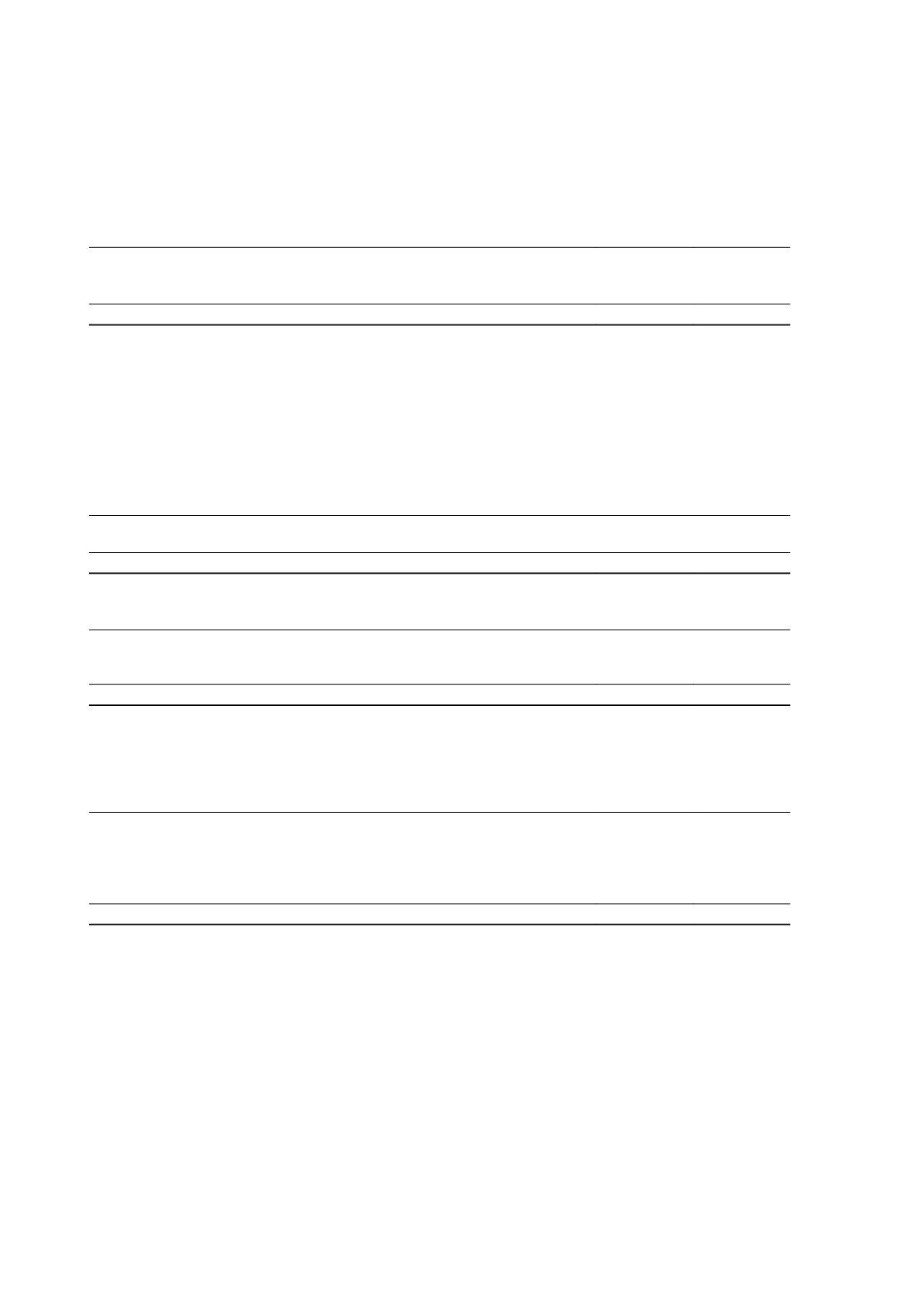

11 Trade and other payables

2016

$'000

2015

$'000

Current liabilities

Trade payables

9,933

8,918

Other payables

97,199

31,558

107,132

40,476

(a) Recognition and measurement

These amounts represent liabilities for goods and services provided to the Group prior to the end of financial year which

are unpaid. The amounts are unsecured and are usually paid within 30 days of recognition. Trade and other payables

are presented as current liabilities unless payment is not due within 12 months from the reporting date. They are

recognised initially at their fair value and subsequently measured at amortised cost using the effective interest method.

12 Provisions

2016

$'000

2015

$'000

Current

Provision for employee entitlements

6,901

7,274

6,901

7,274

2016

$'000

2015

$'000

Non-current

Provision for employee entitlements

1,946

1,727

Provision for rehabilitation costs

66,359

27,660

68,305

29,387

(a) Movements in provisions

Movements in the provision for rehabilitation costs during the financial year are set out below:

2016

$'000

2015

$'000

Carrying amount at beginning of financial year

27,660

24,018

Additional provision

31,439

3,120

Additional provision on acquisition of subsidiary

6,579

-

Rehabilitation and restoration borrowing costs expense

707

590

Payments during the period

(26)

(68)

Carrying amount at end of financial year

66,359

27,660

(b) Recognition and measurement

Provisions are recognised when the Group has a present legal or constructive obligation as a result of past events, it is

probable that an outflow of resources will be required to settle the obligation and the amount can be reliably estimated.

Provisions are not recognised for future operating losses.

Independence Group NL

52