NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

86 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

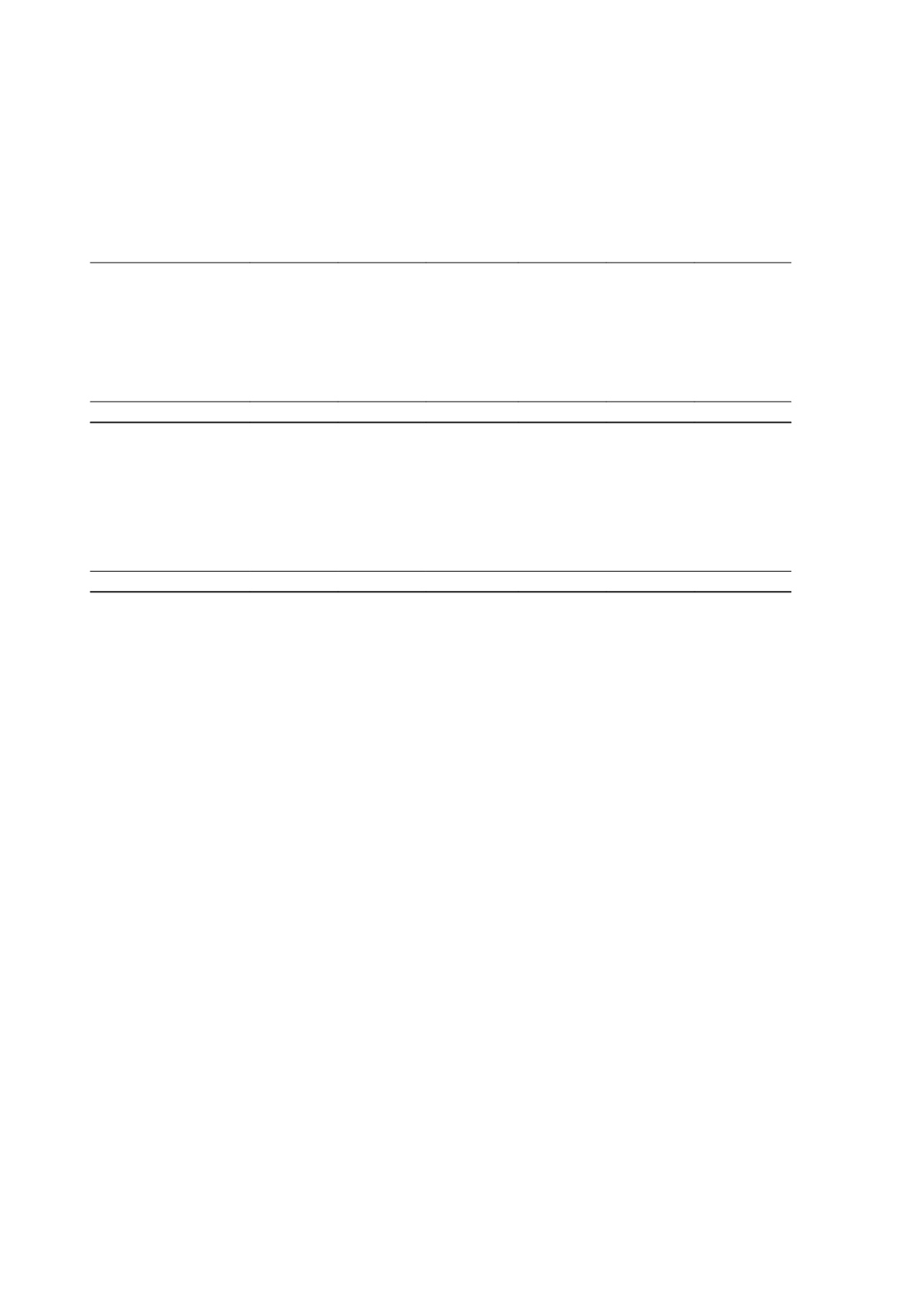

15 Exploration and evaluation

Jaguar

Operation

$'000

Long

Operation

$'000

Nova Project

$'000

Stockman

Project

$'000

Karlawinda

$'000

Total

$'000

Year ended 30 June 2016

Opening net book amount

8,235

-

-

100,716

979

109,930

Acquisition of subsidiary

-

-

34,100

-

-

34,100

Additions

3,152

7,434

-

-

-

10,586

Disposals

-

-

-

-

(979)

(979)

Impairment charge

(2,985)

-

-

(32,533)

-

(35,518)

Transfer to mine

properties in production

(3,152)

(7,434)

-

-

-

(10,586)

Closing net book amount

5,250

-

34,100

68,183

-

107,533

Year ended 30 June 2015

Opening net book amount

9,888

-

-

100,716

979

111,583

Additions

1,611

10,806

-

-

-

12,417

Impairment charge

(2,232)

(1,229)

-

-

-

(3,461)

Transfer to mine

properties in production

(1,032)

(9,577)

-

-

-

(10,609)

Closing net book amount

8,235

-

-

100,716

979

109,930

(a) Impairment

The Group recognised impairment charges of $35,518,000 during the current reporting period (2015: $3,461,000).

An amount of $32,533,000 related to the Stockman Project, which is an exploration asset reported within the New

Business and Regional Exploration Activities segment. The circumstances and events that led to the recognition of the

impairment loss emerged following an assessment for the existence of impairment triggers as at 31 December 2015 in

accordance with AASB6

Exploration for and Evaluation of Mineral Resources.

The recognised impairment charge has

been determined with reference to the recoverable amount of the asset being assessed based on its fair value less

costs of disposal.

The Company adopted a discounted cash flow fair value model to arrive at the recoverable amount. Key assumptions

include a post-tax real discount rate of 10.2%, and five year average commodity prices as follows: Copper: USD5,380

per tonne, Zinc: USD2,076 per tonne, Silver: USD16.50 per ounce and foreign exchange: USD:AUD 0.72.

(b) Recognition and measurement

Exploration for and evaluation of mineral resources is the search for mineral resources after the entity has obtained

legal rights to explore in a specific area, as well as the determination of the technical feasibility and commercial viability

of extracting the mineral resource.

Exploration and evaluation expenditure is expensed to the profit or loss as incurred except in the following

circumstances in which case the expenditure may be capitalised:

• The existence of a commercially viable mineral deposit has been established and it is anticipated that future

economic benefits are more likely than not to be generated as a result of the expenditure; and

• The exploration and evaluation activity is within an area of interest which was acquired as an asset acquisition or in

a business combination and measured at fair value on acquisition.

A regular review is undertaken of each area of interest to determine the appropriateness of continuing to carry forward

costs in relation to that area of interest. An impairment exists when the carrying value of expenditure exceeds its

estimated recoverable amount. The area of interest is then written down to its recoverable amount and the impairment

losses are recognised in profit or loss.

Independence Group NL

58