NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

88 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

Capital structure and financing activities

This section of the notes provides further information about the Group's borrowings, contributed equity, reserves and

dividends, including accounting policies relevant to understanding these items.

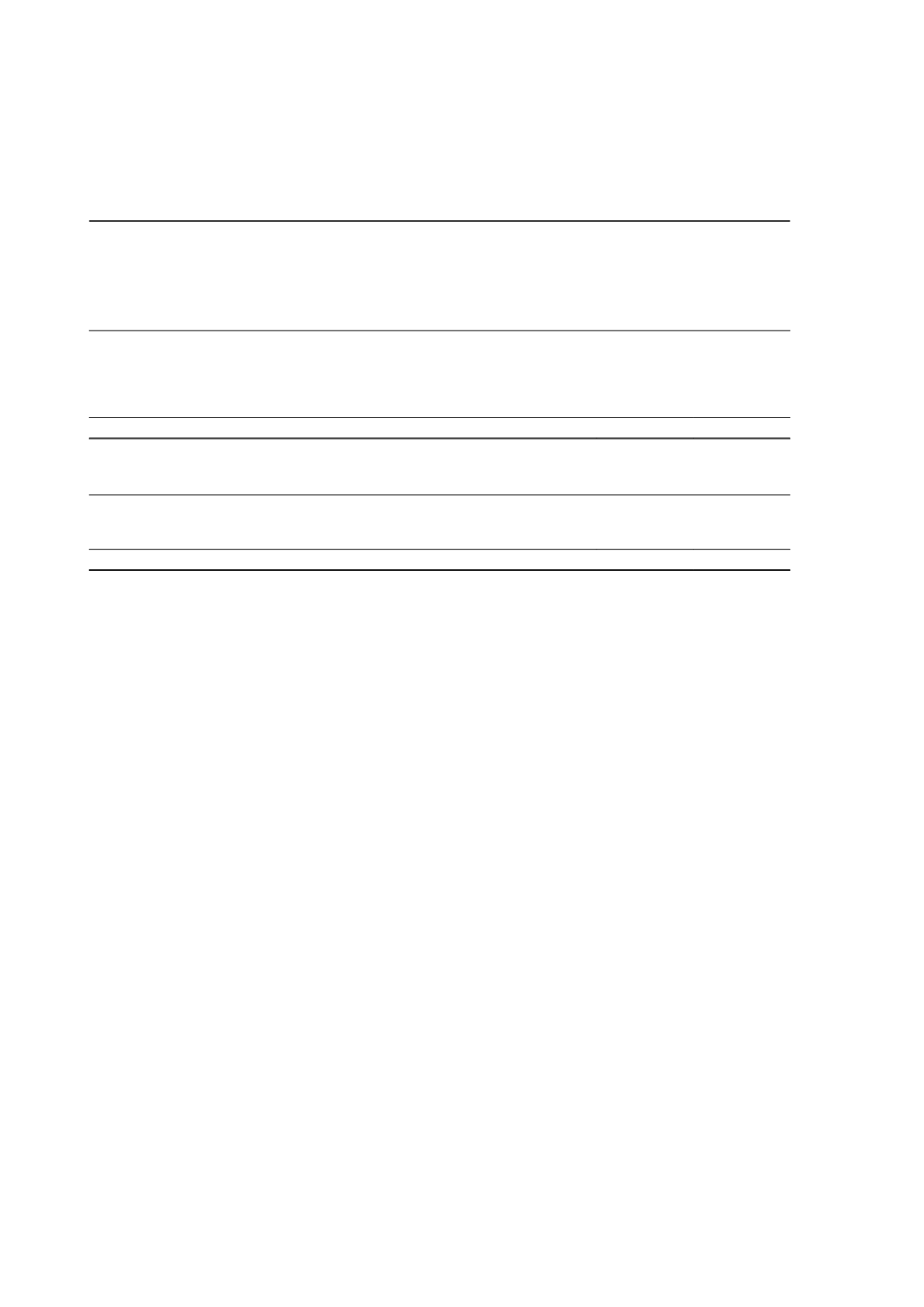

16 Borrowings

2016

$'000

2015

$'000

Current

Secured

Lease liabilities

-

510

Unsecured

Bank loans

43,154

-

Total current borrowings

43,154

510

2016

$'000

2015

$'000

Non-current

Unsecured

Bank loans

222,672

-

Total non-current borrowings

222,672

-

(a) Corporate loan facility

On 16 July 2015, the Company entered into a Syndicated Facility Agreement (Facility Agreement) with National

Australia Bank Limited, Australia and New Zealand Banking Group Limited and Commonwealth Bank of Australia

Limited for a $550,000,000 unsecured committed term finance facility. The Facility Agreement comprises:

• A five year $350,000,000 amortising term loan facility that was used to refinance the existing Nova Project finance

facility, and provide funds for the continued development, construction and operation of the Nova Project; and

• A five year $200,000,000 revolving loan facility that was used to partially fund the payment of the cash component

of the Acquisition Scheme for Sirius Resources NL and transaction costs, in addition to providing funding for

general corporate purposes.

The Facility Agreement replaced the existing Corporate Loan Facility (Loan Facility) which the Company previously had

with National Australia Bank. The Loan Facility comprised a corporate debt facility of $20,000,000, an asset finance

facility of $20,000,000 and a contingent instrument facility of $20,000,000.

Total capitalised transaction costs to 30 June 2016 are $5,549,000 (2015: $nil). Transaction costs are accounted for

under the effective interest rate method. These costs are incremental costs that are directly attributable to the loan and

include loan origination fees, commitment fees and legal fees. At 30 June 2016, a balance of unamortised transaction

costs of $5,174,000 (2015: $nil) was offset against the bank loans contractual liability of $271,000,000 (2015: $nil).

Borrowing costs of $11,055,000 (2015: $nil) relate to a qualifying asset (Nova Project) and have been capitalised in

accordance with AASB 123

Borrowing Costs

. Refer to note 14.

The Facility Agreement has certain financial covenants that the Company has to comply with. All such financial

covenants have been complied with in accordance with the Facility Agreement.

(b) Assets pledged as security

There were no assets pledged as security at 30 June 2016 (2015: $nil).

Independence Group NL

60