NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

94 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

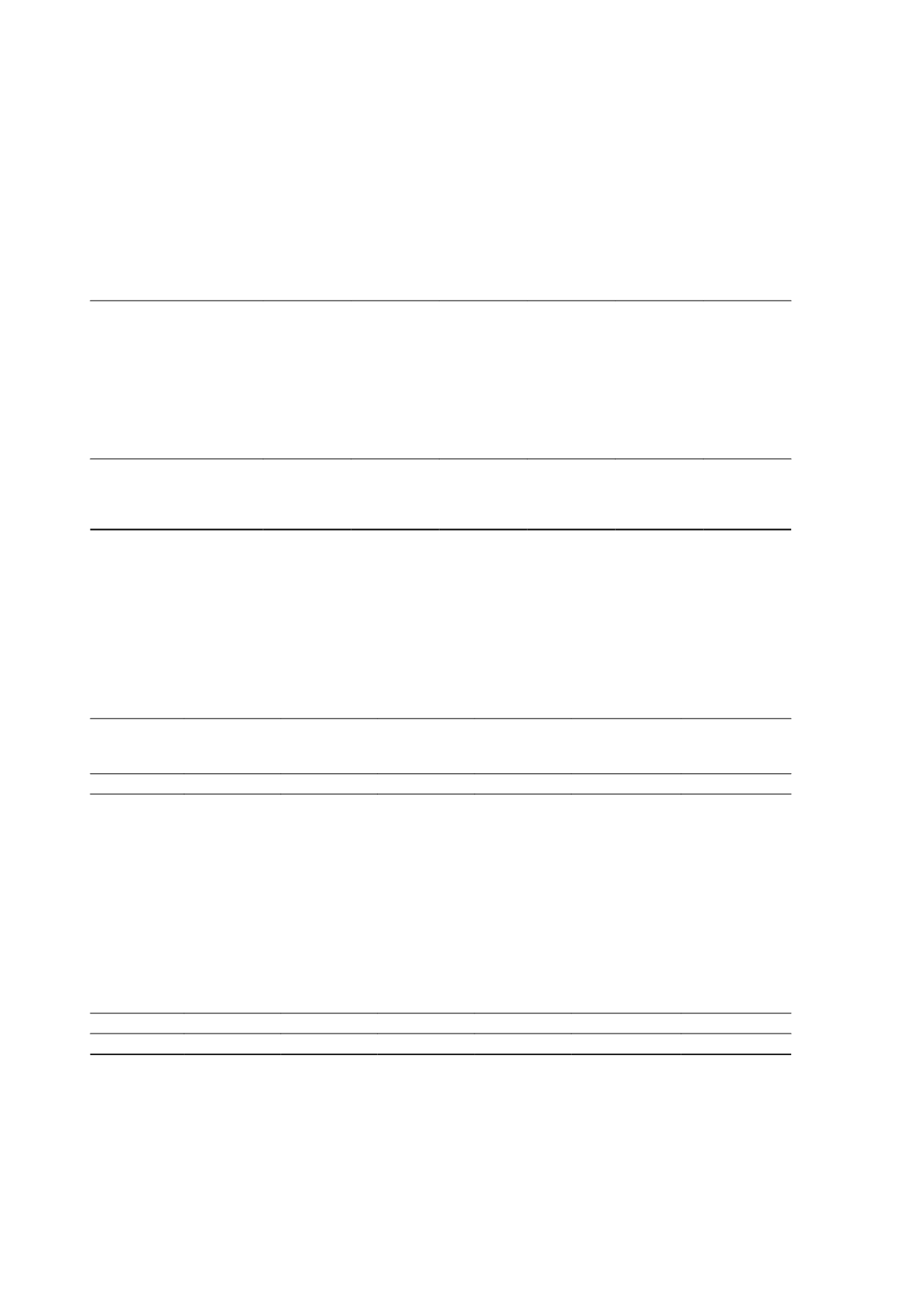

20 Derivatives (continued)

Gold (continued)

Ounces of metal

Weighted average price

(AUD/ounce)

Fair value

2016

2015

2016

2015

2016

$'000

2015

$'000

0 - 6 months

Gold put options purchased

12,500

23,500

1,330

1,350

4

137

Gold call options sold

12,500

23,500

1,593

1,744

(2,491)

(101)

6 - 12 months

Gold put options purchased

-

15,000

-

1,330

-

314

Gold call options sold

-

15,000

-

1,560

-

(1,112)

12 - 18 months

Gold put options purchased

-

12,500

-

1,330

-

460

Gold call options sold

-

12,500

-

1,593

-

(1,177)

Total/weighted average

strike price

Gold put options purchased

12,500

51,000

1,330

1,339

4

911

Gold call options sold

12,500

51,000

1,593

1,653

(2,491)

(2,390)

Diesel

The Group held various diesel fuel hedging contracts at 30 June 2016 to reduce the exposure to future increases in the

price of the Singapore gasoil component of diesel fuel.

The following table details the diesel fuel hedging contracts outstanding at the reporting date:

Barrels of oil

Weighted average price

(AUD/barrel)

Fair value

2016

2015

2016

2015

2016

$'000

2015

$'000

0 - 6 months

20,228

-

61.50

-

341

-

6 -12 months

29,532

-

65.61

-

443

-

1 - 2 years

60,525

-

74.37

-

799

-

Total

110,285

-

69.67

-

1,583

-

Nickel

There were no nickel commodity contracts held by the Group at 30 June 2016. The tables below detail the outstanding

nickel commodity contracts denominated in United States dollars (USD), and the foreign exchange contracts which

match the terms of the commodity contracts, held by the Group at 30 June 2015. These contracts were used to reduce

the exposure to a future decrease in the Australian dollar (AUD) market value of nickel sales.

The following table details the nickel contracts outstanding at the reporting date:

Tonnes of metal

Weighted average price

(USD/metric tonne)

Fair value

2016

2015

2016

2015

2016

$'000

2015

$'000

0 - 3 months

-

750

-

16,711

-

4,626

Total

-

750

-

16,711

-

4,626

The following table details the forward foreign currency contracts outstanding at the reporting date:

Independence Group NL

66