NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

Annual Report 2016 95

Notes to the consolidated financial statements

30 June 2016

(continued)

20 Derivatives (continued)

Nickel (continued)

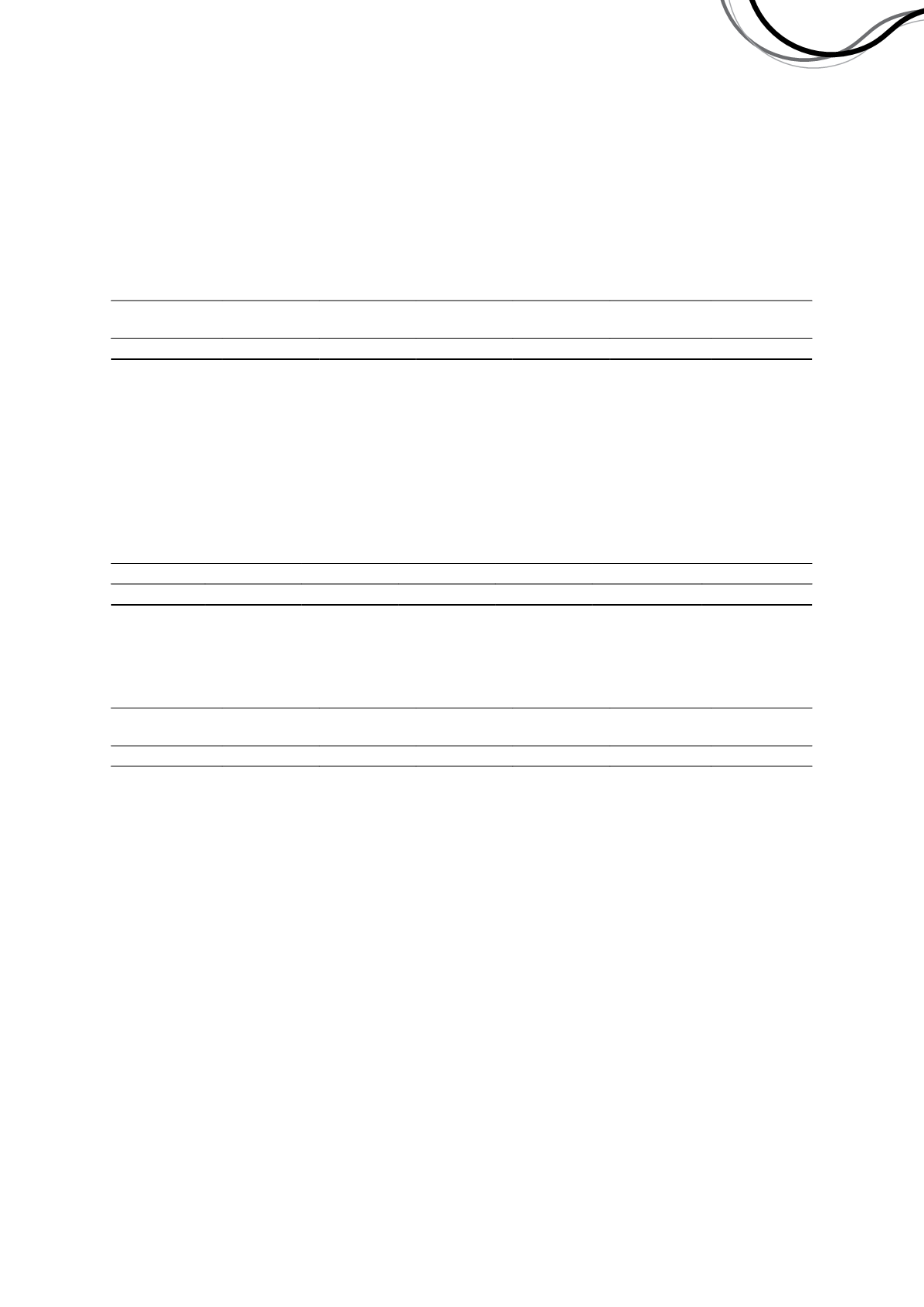

Notional amounts (USD)

Weighted average

AUD:USD exchange rate

Fair value

2016

$'000

2015

$'000

2016

2015

2016

$'000

2015

$'000

Sell USD forward

0 - 3 months

-

12,534

-

0.8482

-

(1,533)

Total

-

12,534

-

0.8482

-

(1,533)

Copper

There were no copper commodity contracts held by the Group at 30 June 2016. The tables below detail the outstanding

copper commodity contracts denominated in USD, and the foreign exchange contracts which match the terms of the

commodity contracts, held by the Group at 30 June 2015. These contracts were used to reduce the exposure to a future

decrease in the AUD market value of copper sales.

The following table details the copper contracts outstanding at the reporting date:

Tonnes of metal

Weighted average price

(USD/metric tonne)

Fair value

2016

2015

2016

2015

2016

$'000

2015

$'000

0 - 3 months

-

550

-

6,261

-

355

Total

-

550

-

6,261

-

355

The following table details the forward foreign currency contracts outstanding at the reporting date:

Notional amounts (USD)

Weighted average

AUD:USD exchange rate

Fair value

2016

$'000

2015

$'000

2016

2015

2016

$'000

2015

$'000

Sell USD forward

0 - 3 months

-

3,444

-

0.7825

-

(89)

Total

-

3,444

-

0.7825

-

(89)

(b) Change in accounting policy

The Group has early adopted the new accounting standard AASB 9

Financial Instruments

with effect from 1 July 2015.

As explained in note 31, the adoption of the standard has affected the accounting treatment of the fair value of certain

derivative assets and liabilities. The adoption of the standard had no impact on the net assets of the Group, however

resulted in the restatement of balances at 1 July 2015 with a reduction in accumulated losses of $1,036,000 and a

corresponding debit in the hedging reserve of $1,036,000.

(c) Recognition and measurement

Derivatives are initially recognised at fair value on the date a derivative contract is entered into and are subsequently

remeasured to their fair value at the end of each reporting period. The accounting for subsequent changes in fair value

depends on whether the derivative is designated as a hedging instrument, and if so, the nature of the item being

hedged. The Group designates certain derivatives as either:

• hedges of the fair value of recognised assets or liabilities or a firm commitment (fair value hedges); or

• hedges of a particular risk associated with the cash flows of recognised assets and liabilities and highly probable

forecast transactions (cash flow hedges).

The Group documents, at the inception of the hedging transaction, the relationship between hedging instruments and

hedged items, as well as its risk management objective and strategy for undertaking various hedge transactions. The

Group also documents its assessment, both at hedge inception and on an ongoing basis, of whether the derivatives that

are used in hedging transactions have been and will continue to be highly effective in offsetting changes in fair values or

cash flows of hedged items.

Independence Group NL

67