NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

Annual Report 2016 97

Notes to the consolidated financial statements

30 June 2016

(continued)

21 Financial risk management (continued)

(a) Risk exposures and responses (continued)

(i)

Foreign currency risk (continued)

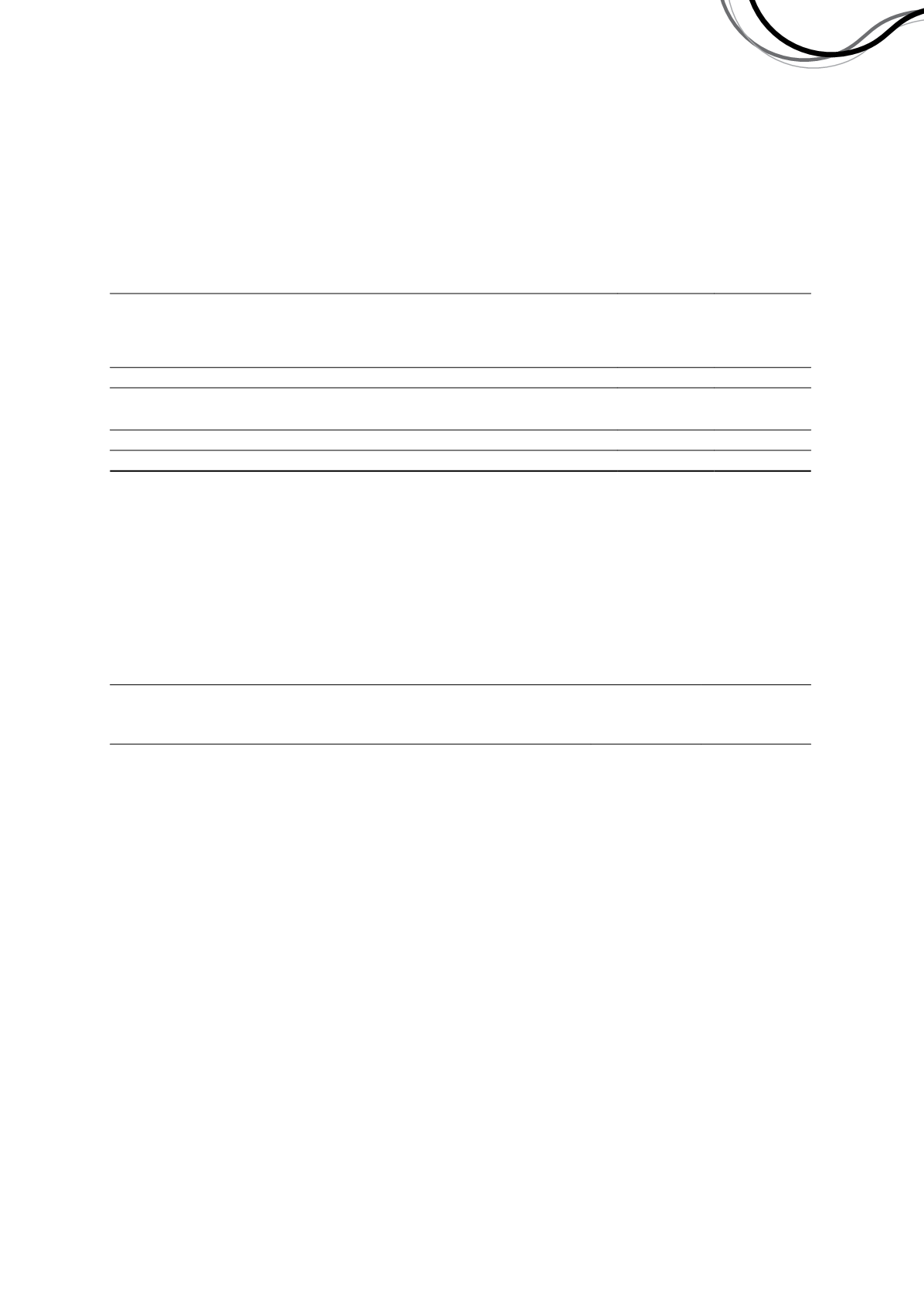

2016

$'000

2015

$'000

Financial assets

Cash and cash equivalents

14,773

16,971

Trade and other receivables

19,969

15,506

Derivative financial instruments

-

4,981

34,742

37,458

Financial liabilities

Derivative financial instruments

-

1,622

-

1,622

Net financial assets

34,742

35,836

The cash balance above only represents the cash held in the USD bank accounts at the reporting date and converted

into AUD at the 30 June 2016 AUD:USD exchange rate of $0.7426 (2015: $0.7680). The remainder of the cash balance

of $31,491,000 (2015: $104,325,000) was held in AUD and therefore not exposed to foreign currency risk.

The trade and other receivables amounts represent the USD denominated trade debtors. All other trade and other

receivables were denominated in AUD at the reporting date.

The following table summarises the Group’s sensitivity of financial instruments held at 30 June 2016 to movements in

the AUD:USD exchange rate, with all other variables held constant.

Impact on post-tax profit

Sensitivity of financial instruments to foreign currency movements

2016

$'000

2015

$'000

Increase/decrease in foreign exchange rate

Increase 5.0%

(884)

(110)

Decrease 5.0%

988

132

(ii)

Commodity price risk

The Group’s sales revenues are generated from the sale of nickel, copper, zinc, silver and gold. Accordingly, the

Group’s revenues, derivatives and trade receivables are exposed to commodity price risk fluctuations, primarily nickel,

copper, zinc, silver and gold.

Nickel

Nickel ore sales have an average price finalisation period of three months until the sale is finalised with the customer.

It is the Board’s policy to hedge between 0% and 70% of total nickel production tonnes.

Copper and zinc

Copper and zinc concentrate sales have an average price finalisation period of up to four months from shipment date.

It is the Board’s policy to hedge between 0% and 70% of total copper and zinc production tonnes.

Gold

It is the Board’s policy to hedge between 0% and 70% of forecast gold production from the Company’s 30% interest in

the Tropicana Gold Mine.

Diesel fuel

It is the Board's policy to hedge up to 75% of forecast diesel fuel usage. Diesel fuel price comprises a number of

components, including Singapore gasoil and various other costs such as shipping and insurance. The total of all costs

represent the wholesale or Terminal Gate Price (TGP) of diesel. The Group only hedges the Singapore gasoil

component of the diesel TGP, which represents approximately 40% of the total diesel price.

Independence Group NL

69