NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

98 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

21 Financial risk management (continued)

(a) Risk exposures and responses (continued)

(ii)

Commodity price risk (continued)

The markets for nickel, copper, zinc, silver and gold are freely traded and can be volatile. As a relatively small producer,

the Group has no ability to influence commodity prices. The Group mitigates this risk through derivative instruments,

including, but not limited to, quotational period hedging, forward contracts and collar arrangements.

At the reporting date, the carrying value of the financial instruments exposed to commodity price movements were as

follows:

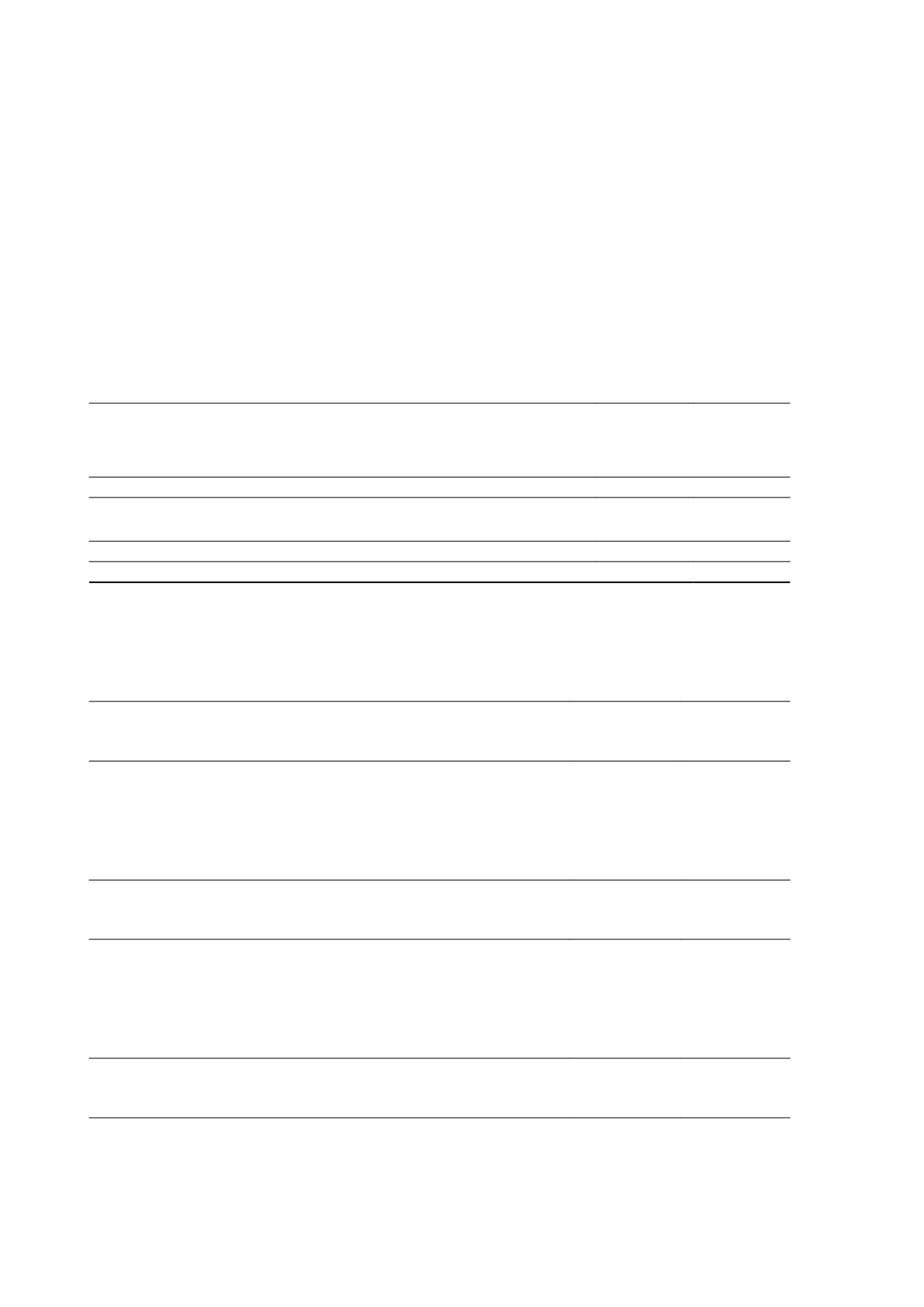

Financial instruments exposed to commodity price movements

2016

$'000

2015

$'000

Financial assets

Trade and other receivables

18,520

10,702

Derivative financial instruments - commodity hedging contracts

-

4,981

Derivative financial instruments - diesel hedging contracts

1,583

-

20,103

15,683

Financial liabilities

Derivative financial instruments - commodity hedging contracts

2,487

1,479

2,487

1,479

Net exposure

17,616

14,204

The following table summarises the sensitivity of financial instruments held at 30 June 2016 to movements in the nickel

price, with all other variables held constant. Trade receivables valuation uses a sensitivity analysis of 1.5% (2015: 1.5%)

and a 20.0% (2015: 20.0%) sensitivity rate is used to value derivative contracts.

Impact on post-tax profit

Sensitivity of financial instruments to nickel price movements

2016

$'000

2015

$'000

Increase/decrease in nickel prices

Increase

177

(1,517)

Decrease

(177)

1,517

The following table summarises the sensitivity of financial instruments held at 30 June 2016 to movements in the copper

price, with all other variables held constant. Trade receivables valuation uses a sensitivity analysis of 1.5% (2015: 1.5%)

and a 20.0% (2015: 20.0%) sensitivity rate is used to value derivative contracts.

Impact on post-tax profit

Sensitivity of financial instruments to copper price movements

2016

$'000

2015

$'000

Increase/decrease in copper price

Increase

251

(572)

Decrease

(251)

572

The following table summarises the sensitivity of financial instruments held at 30 June 2016 to movements in the gold

price, with all other variables held constant.

Impact on other components of

equity

Sensitivity of financial instruments to gold price movements

2016

$'000

2015

$'000

Increase/decrease in gold price

Increase 20% (2015: 20%)

(3,018)

(6,590)

Decrease 20% (2015: 20%)

1,743

5,325

Independence Group NL

70