NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

Annual Report 2016 101

Notes to the consolidated financial statements

30 June 2016

(continued)

21 Financial risk management (continued)

(b) Credit risk (continued)

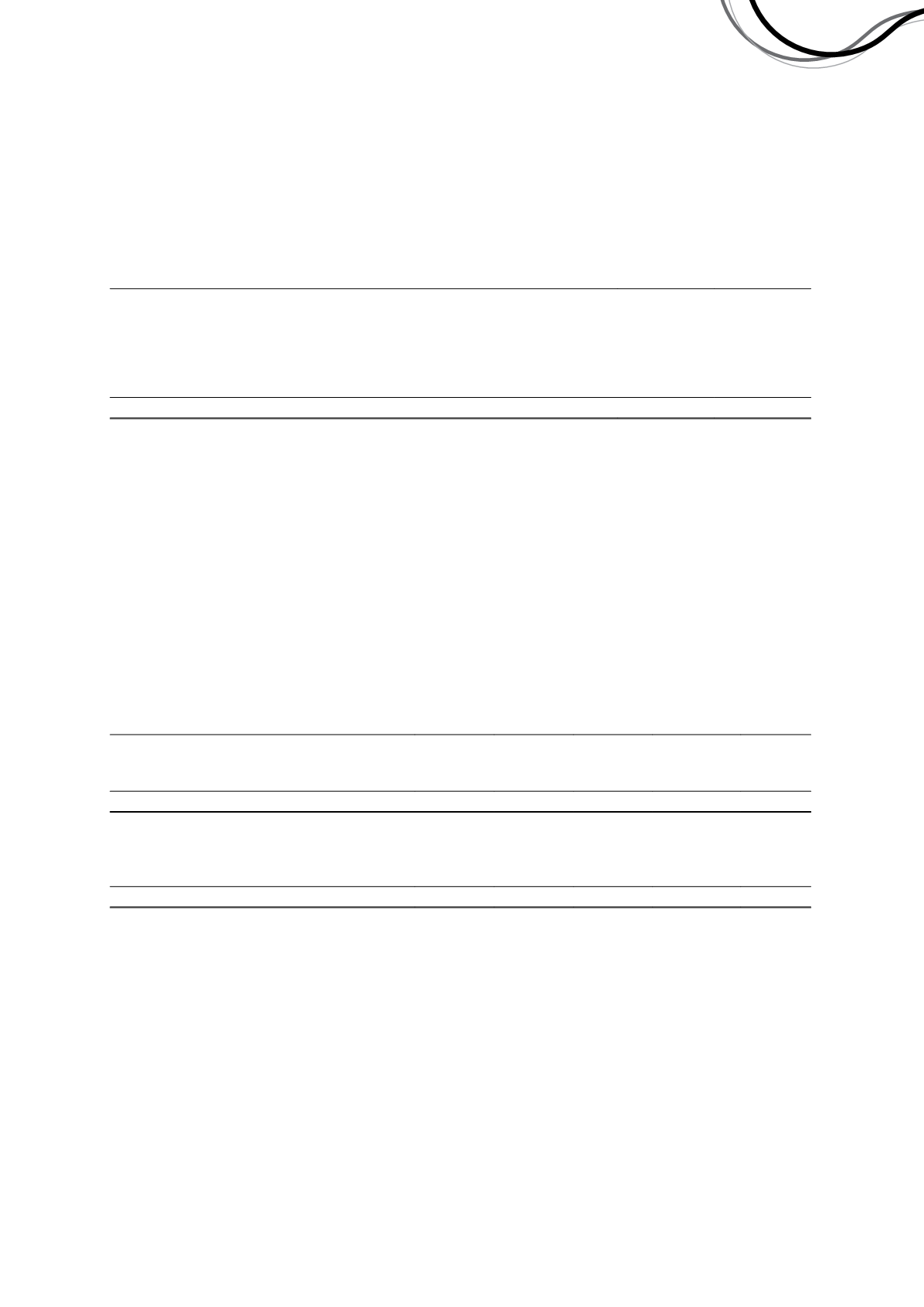

Consolidated entity

2016

$'000

2015

$'000

Financial assets

Cash and cash equivalents

46,264

121,296

Trade and other receivables

21,561

13,481

Other receivables

6,559

5,384

Financial assets

5,017

15,574

Derivative financial instruments

1,583

4,981

80,984

160,716

On analysis of trade and other receivables, no balances are impaired for either 30 June 2016 or 30 June 2015. Trade

receivables balance includes $1,448,000 (2015: $nil) that are past due but not impaired.

(c) Liquidity risk

Liquidity risk is the risk that the Group will not be able to meet its financial liabilities as they fall due. The Group’s

approach to managing liquidity risk is to ensure, as far as possible, that it will always have sufficient liquidity to meet its

liabilities when due, under both normal and stressed conditions, without incurring unacceptable losses or risking

damage to the Group’s reputation. Management and the Board monitors liquidity levels on an ongoing basis.

Maturities of financial liabilities

The following table details the Group’s remaining contractual maturity for its non-derivative financial liabilities. The

tables are based on the undiscounted cash flows of financial liabilities based on the earliest date on which the Group

can be required to pay.

Contractual maturities of financial liabilities Less than 6

months

6 - 12

months

Between

1 and 5

years

Total

contractual

cash

flows

Carrying

amount

$'000

$'000

$'000

$'000

$'000

At 30 June 2016

Trade and other payables

107,132

-

-

107,132 107,132

Bank loans*

6,070

46,735 243,056

295,861 265,826

113,202

46,735 243,056

402,993 372,958

At 30 June 2015

Trade and other payables

40,476

-

-

40,476 40,476

Finance lease liabilities

458

64

-

522

510

40,934

64

-

40,998 40,986

* Includes estimated interest payments.

The following table details the Group’s liquidity analysis for its derivative financial instruments. The table is based on the

undiscounted net cash inflows/(outflows) on the derivative instrument that settles on a net basis. When the net amount

payable is not fixed, the amount disclosed has been determined by reference to the projected forward curves existing at

the reporting date.

Independence Group NL

73