NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

100 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

21 Financial risk management (continued)

(a) Risk exposures and responses (continued)

(iv)

Cash flow and fair value interest rate risk (continued)

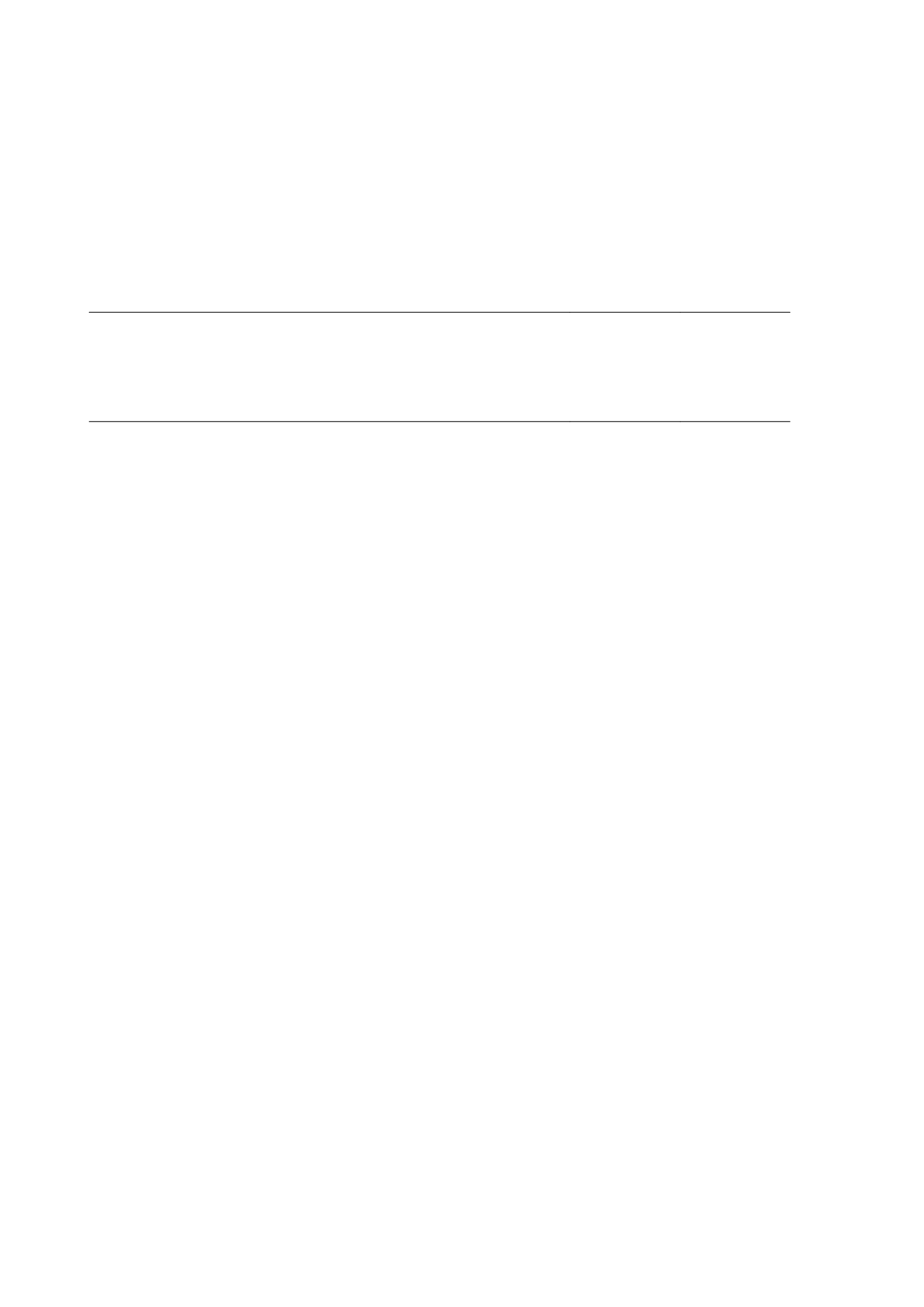

Impact on post-tax profit

Sensitivity of interest revenue and expense to interest rate movements

2016

$'000

2015

$'000

Interest revenue

Increase 1.0% (2015: 1.0%)

276

804

Decrease 1.0% (2015: 1.0%)

(276)

(804)

Interest expense

Increase 1.0% (2015: 1.0%)

(1,897)

-

Decrease 1.0% (2015: 1.0%)

1,897

-

(b) Credit risk

Nickel ore sales

The Group has a concentration of credit risk in that it depends on BHP Billiton Nickel West Pty Ltd (BHPB Nickel West)

for a significant volume of revenue. During the year ended 30 June 2016 all nickel sales revenue was sourced from this

company. The risk is mitigated in that the agreement relating to sales revenue contains provision for the Group to seek

alternative revenue providers in the event that BHPB Nickel West is unable to accept supply of the Group’s product due

to a force majeure event. The risk is further mitigated by the receipt of 70% of the value of any months’ sale within a

month of that sale occurring.

Copper and zinc concentrate sales

Credit risk arising from sales to customers is managed by contracts that stipulate a provisional payment of at least 90%

of the estimated value of each sale. This is generally paid promptly after vessel loading. Title to the concentrate does

not pass to the buyer until this provisional payment is received by the Group.

Due to the large size of concentrate shipments, there are a relatively small number of transactions each month and

therefore each transaction and receivable balance is actively managed on an ongoing basis, with attention to timing of

customer payments and imposed credit limits. The resulting exposure to bad debts is not considered significant.

Gold bullion sales

Credit risk arising from the sale of gold bullion to the Company's customer is low as the payment by the customer (being

The Perth Mint Australia) is guaranteed under statute by the Western Australian State Government. In addition, sales

are made to high credit quality financial institutions, hence credit risk arising from these transactions is considered to be

low.

The Group has policies in place to ensure that sales of products are made to customers with an appropriate credit

history.

Other

In respect of financial assets and derivative financial instruments, the Group's exposure to credit risk arises from

potential default of the counterparty, with a maximum exposure equal to the carrying amount of these instruments.

Exposure at the reporting date is addressed below. The Group does not hold any credit derivatives to offset its credit

exposure.

Derivative counterparties and cash transactions are restricted to high credit quality financial institutions.

The maximum exposure to credit risk at the reporting date was as follows:

Independence Group NL

72