NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

92 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

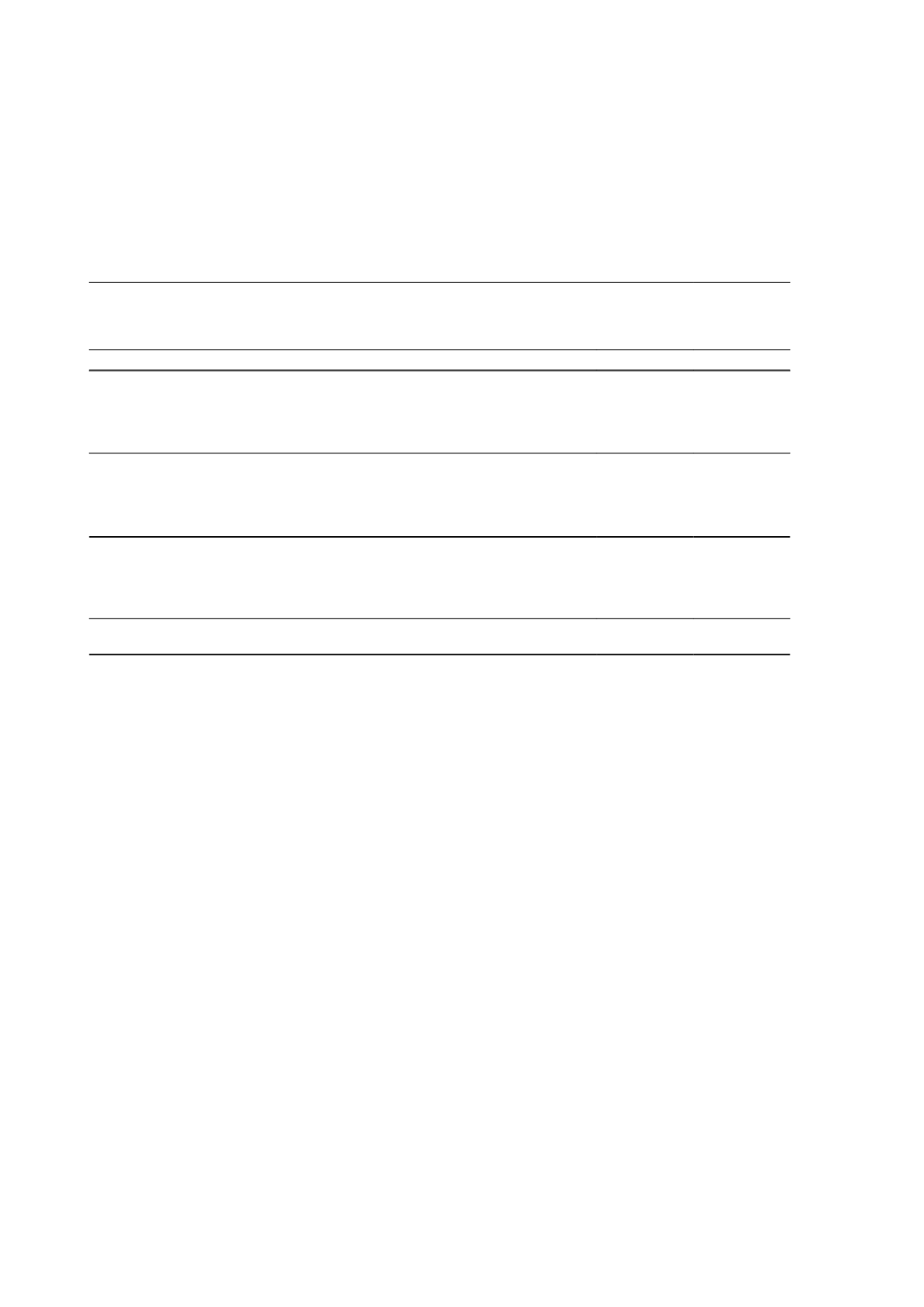

19 Dividends paid and proposed

(a) Ordinary shares

2016

$'000

2015

$'000

Final ordinary dividend for the year ended 30 June 2015 of 2.5 cents (2014: 5 cents)

per fully paid share

12,786

11,713

Interim dividend for the year ended 30 June 2016 of nil cents (2015: 6 cents) per fully

paid share

-

14,055

Total dividends paid during the financial year

12,786

25,768

(b) Dividends not recognised at the end of the reporting period

2016

$'000

2015

$'000

In addition to the above dividends, since year end the Directors have recommended

the payment of a final dividend of 2 cents (2015: 2.5 cents) per fully paid ordinary

share, fully franked based on tax paid at 30%. The aggregate amount of the proposed

dividend expected to be paid on 23 September 2016 out of retained earnings at 30

June 2016, but not recognised as a liability at year end, is:

11,734

12,786

(c) Franked dividends

2016

$'000

2015

$'000

Franking credits available for subsequent reporting periods based on a tax rate of 30%

(2015: 30%)

42,373

47,845

The above amounts are calculated from the balance of the franking account as at the end of the reporting period,

adjusted for:

(a)

franking credits that will arise from the payment of the amount of the provision for income tax;

(b)

franking debits that will arise from the payment of dividends recognised as a liability at the reporting date; and

(c)

franking credits that will arise from the receipt of dividends recognised as receivables at the reporting date.

The impact on the franking account of the dividend recommended by the Directors since the end of the reporting period,

but not recognised as a liability at the reporting date, will be a reduction in the franking account of $5,029,000 (2015:

$5,480,000).

(d) Recognition and measurement

Provision is made for the amount of any dividend declared, being appropriately authorised and no longer at the

discretion of the entity, on or before the end of the reporting period but not distributed at the end of the reporting period.

A provision for dividends is not recognised as a liability unless the dividends are declared, determined or publicly

recommended on or before the balance sheet date.

Independence Group NL

64