NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

90 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

17 Contributed equity (continued)

(a) Share capital (continued)

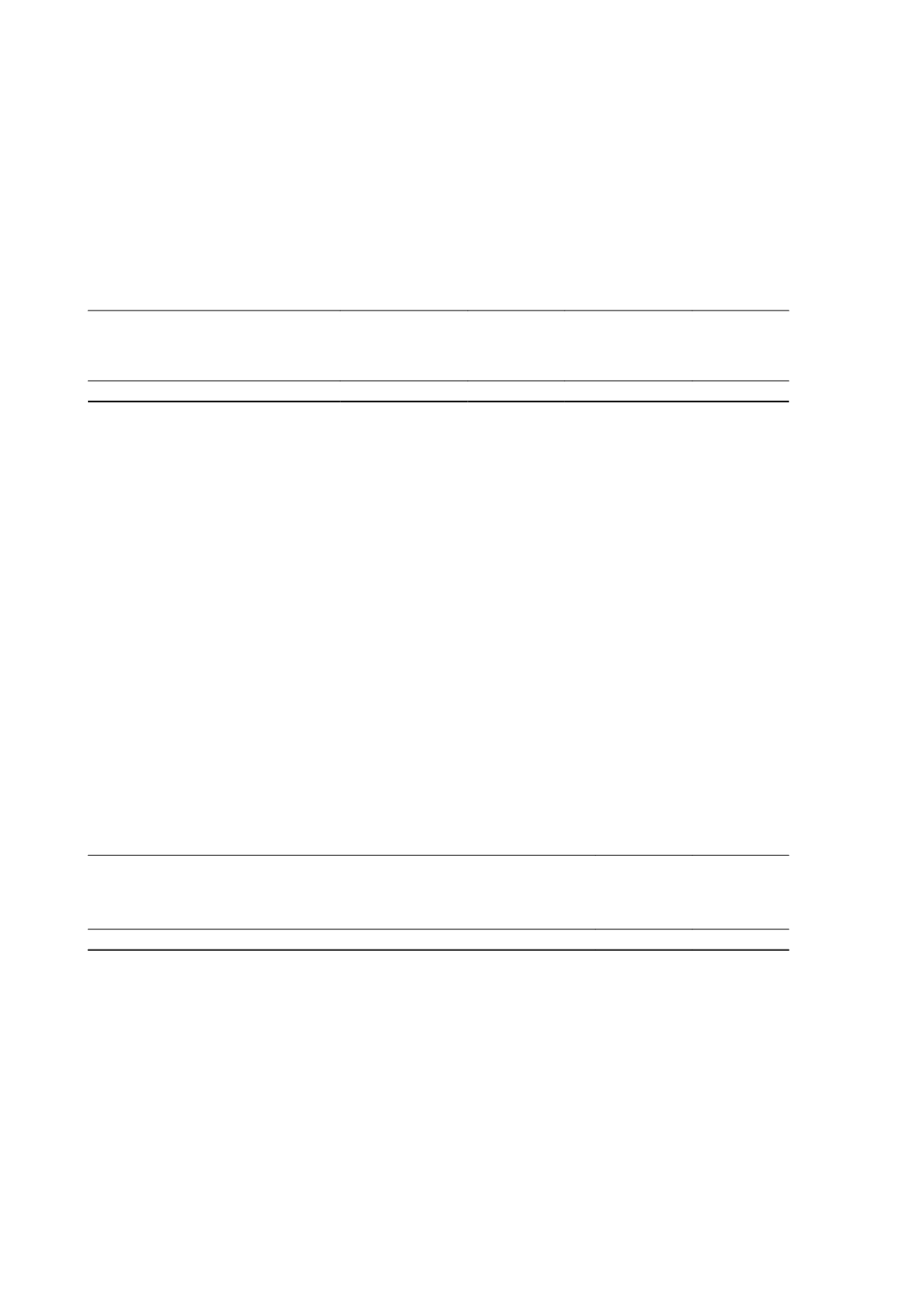

(b) Movements in ordinary share capital

Details

2016

Number of shares

2016

$'000

2015

Number of shares

2015

$'000

Balance at beginning of financial year

234,256,573

737,324

233,323,905

735,060

Issue of shares under the Employee

Performance Rights Plan

1,323,614

3,505

932,668

2,264

Acquisition of subsidiary

275,842,684

860,629

-

-

Balance at end of financial year

511,422,871

1,601,458

234,256,573

737,324

(c) Capital management

The Board’s policy is to maintain a strong capital base so as to maintain investor, creditor and market confidence and to

sustain future development of the business.

The capital structure of the Group consists of debt, which includes the borrowings, cash and cash equivalents and

equity, comprising issued capital, reserves and retained earnings.

Operating cash flows are used to maintain and expand the Group’s operating and exploration assets, as well as to

make dividend payments. The Board and management assess various financial ratios to determine the Group’s debt

levels and capital structure prior to making any major investment or expansion decisions.

None of the Group’s entities are currently subject to externally imposed capital requirements.

There were no changes in the Group’s approach to capital management during the year.

(d) Recognition and measurement

Ordinary shares are classified as equity. Incremental costs directly attributable to the issue of new shares or options are

shown in equity as a deduction, net of tax, from the proceeds. Ordinary shares entitle the holder to participate in

dividends and the proceeds on winding up of the Company in proportion to the number of and amounts paid on the

shares held. Every holder of ordinary shares present at a meeting in person or by proxy, is entitled to one vote, and

upon a poll each share is entitled to one vote.

18 Reserves

2016

$'000

2015

$'000

Hedging reserve

(632)

-

Share-based payments reserve

10,371

13,057

Foreign currency translation

(8)

(8)

Acquisition reserve

3,142

3,142

12,873

16,191

(a) Movements in reserves

The following table shows a breakdown of the movements in these reserves during the year. A description of the nature

and purpose of each reserve is provided below the table.

Independence Group NL

62