56 Independence Group NL

DIRECTORS’ REPORT

Directors' report

30 June 2016

(continued)

Remuneration report (continued)

Additional statutory information

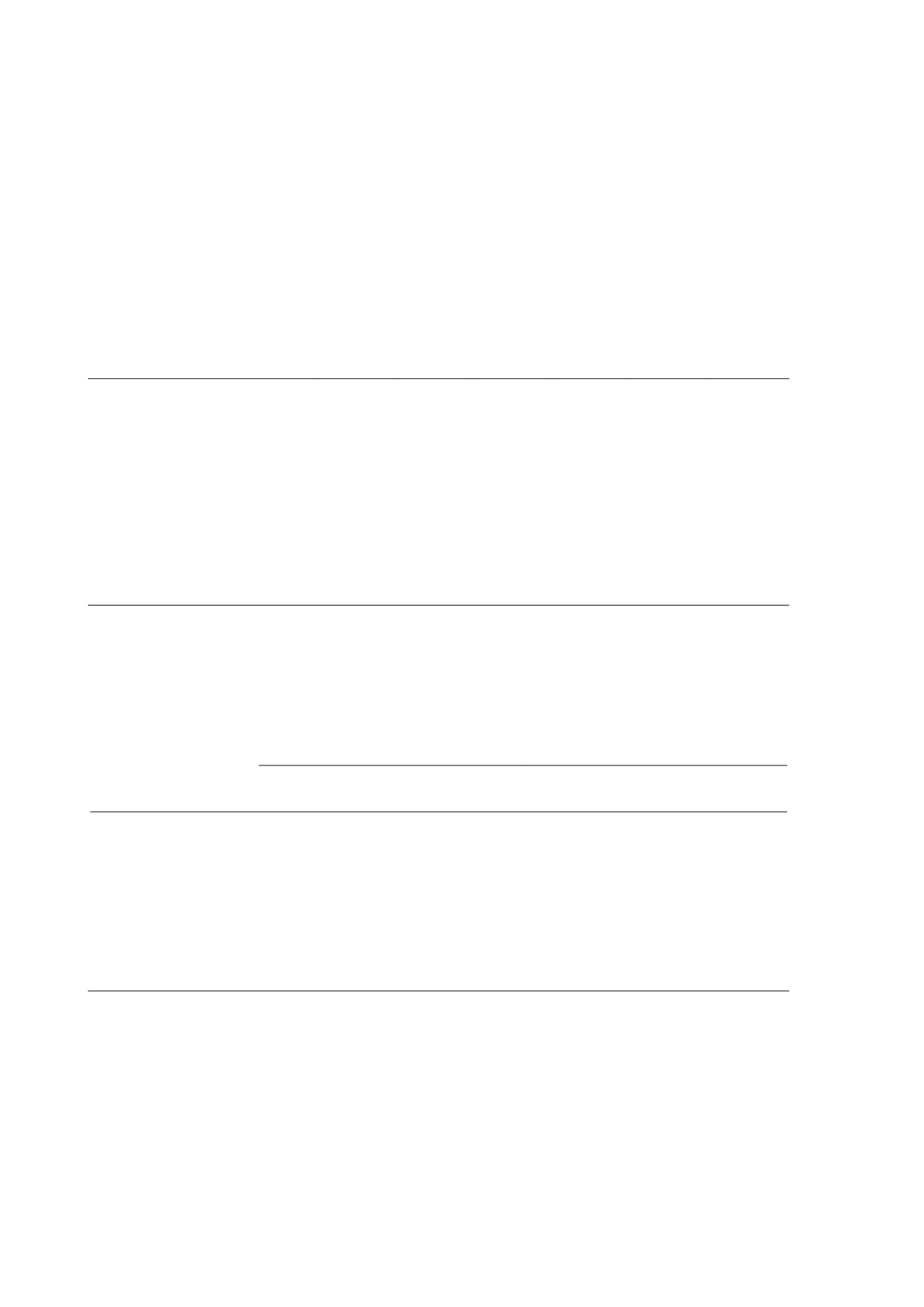

(i) Relative proportions of fixed vs variable remuneration expense

The following table shows the relative proportions of remuneration that are linked to performance and those that are

fixed, based on the amounts disclosed as statutory remuneration expense:

Name

Fixed remuneration

1

At risk - STI

At risk - LTI

2016

%

2015

%

2016

%

2015

%

2016

%

2015

%

Executive Directors of

Independence Group NL

Peter Bradford

58

83

21

-

21

17

Other key management personnel

of the group

Keith Ashby

99

100

-

-

1

-

Rob Dennis

93

-

-

-

7

-

Matt Dusci

72

93

16

-

12

7

Joanne McDonald

99

-

-

-

1

-

Sam Retallack

88

78

8

6

4

16

Scott Steinkrug

66

71

14

6

20

23

Brett Hartmann

61

71

20

7

19

22

Tony Walsh

63

76

37

8

-

16

1. Fixed remuneration paid is not based upon any measurable performance indicators. Non-performance based remuneration is based

on relative industry remuneration levels and is set at a level designed to retain the services of the director or senior executive.

(ii) Performance based remuneration granted and forfeited during the year

The table below shows for each KMP how much of their STI cash bonus was awarded and how much was forfeited. It

also shows the value of share rights that were granted, vested and forfeited during FY16. The number of share rights

and percentages vested/forfeited for each grant are disclosed on page 57 below.

Total STI bonus (cash)

LTI Share Rights

2016

Total

opportunity Awarded Forfeited

Value

granted

1

Value

vested

2

Value

forfeited

2

$

%

%

$

$

$

Peter Bradford

300,000

90

10

399,913

-

-

Keith Ashby

3

-

-

-

23,186

-

-

Rob Dennis

3

-

-

-

93,548

-

-

Matt Dusci

97,500

92

8

74,456

-

-

Joanne McDonald

3

-

-

-

12,677

-

-

Sam Retallack

35,250

99

1

23,806

42,893

13,553

Scott Steinkrug

90,000

92

8

74,456

96,468

32,158

Brett Hartmann

113,750

79

21

86,865

103,982

34,661

Tony Walsh

97,500

77

23

-

-

-

1. The value at grant date for share rights granted during the year as part of remuneration is calculated in accordance with AASB 2

Share-based Payment

. Refer to note 26 for details of the valuation techniques used for the PRP.

2. Value of shares vested and forfeited is based on the value of the share right at grant date.

3. Not eligible for STI as not employed by the Company in FY15 or did not meet the minimum qualifying period.

Independence Group NL

27