Annual Report 2016 53

DIRECTORS’ REPORT

Directors' report

30 June 2016

(continued)

Remuneration report (continued)

Executive Contracts (continued)

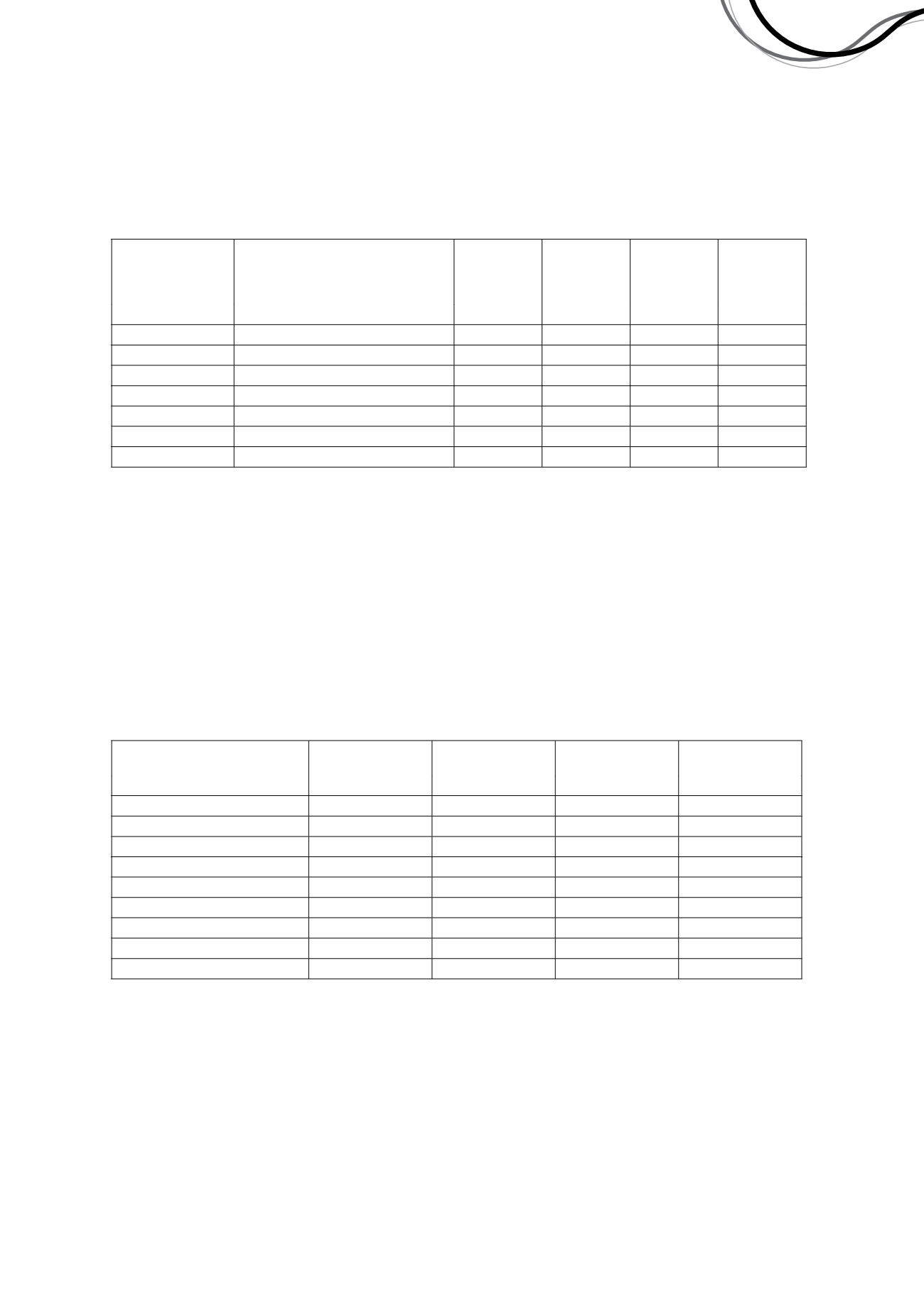

Name

Position

Term of

agreement

Base salary

including

super-

annuation

Notice

period

Termination

benefit

$

Peter Bradford Managing Director

No fixed term 800,000

6 months 6 months

1

Keith Ashby

Sustainability Manager

No fixed term 333,975

3 months

6 months

Rob Dennis

Chief Operating Officer

No fixed term 498,255

3 months

6 months

Matt Dusci

Chief Growth Officer

No fixed term 420,000

3 months

6 months

Joanne McDonald Company Secretary

No fixed term 280,000

3 months

6 months

Sam Retallack

Organisational Capability Manager No fixed term 333,975

3 months

6 months

Scott Steinkrug Chief Financial Officer

No fixed term 420,000

3 months

6 months

1. In addition to the above, Mr Bradford is entitled to a maximum termination benefit payable of up to 12 months of average annual base

salary should the Company terminate the employment contract without cause, but only if such payment would not breach ASX Listing

Rules. A termination benefit of three month's remuneration is payable to Mr Bradford should the Company terminate the employment

contract due to illness, injury or incapacity.

Remuneration expenses for KMP's

The following table shows the cash value of earnings realised by executive KMP during FY16. The cash value of

earnings realised include cash salary, superannuation and cash bonuses received in cash during the year and the

intrinsic value of LTI vesting during the financial year.

This is in addition and different to the disclosures required by the

Corporations Act

and Accounting Standards,

particularly in relation to share rights. As a general principle, the Accounting Standards require a value to be placed on

share rights based on probabilistic calculations at the time of grant, which may be reflected in the remuneration report

even if ultimately the share rights do not vest because performance and service hurdles are not met. By contrast, this

table discloses the intrinsic value of share rights, which represents only those share rights which actually vest and result

in shares issued to a KMP. The intrinsic value is the Company’s closing share price on the date of vesting.

Name

Fixed

Remuneration

1

STI

2

LTI

3

Total Actual

Remuneration

$

$

$

$

Peter Bradford

750,000

270,000

-

1,020,000

Keith Ashby

333,975

-

-

333,975

Rob Dennis

4

171,690

-

-

171,690

Matt Dusci

390,000

90,000

-

480,000

Joanne McDonald

5

187,345

-

-

187,345

Sam Retallack

333,975

35,000

42,732

411,707

Scott Steinkrug

390,000

90,000

161,147

641,147

Brett Hartmann

6

305,062

90,000

173,696

568,758

Tony Walsh

7

123,847

75,000

-

198,847

1. Includes base salary and superannuation.

2. Represents the amount paid in the financial year for performance in FY15.

3. Value of share rights granted in FY12 and vesting on 6 August 2015 at a market price of $3.44.

4. Appointed to KMP on 1 March 2016.

5. Appointed to KMP on 5 October 2015.

6. Ceased to be a KMP on 29 February 2016.

7. Ceased employment with the Company on 9 October 2015.

Independence Group NL

24