Annual Report 2016 49

DIRECTORS’ REPORT

Directors' report

30 June 2016

(continued)

Remuneration report (continued)

2016 Executive remuneration (continued)

Variable remuneration - STIs (continued)

3. To be paid in September 2016.

4. Not qualified as only commenced in April 2015 (minimum 5 months required).

5. Appointed Chief Operating Officer on 1 March 2016, previously General Manager, Project Development (from 22 September 2015)

and prior to that Chief Operating Officer of Sirius Resources NL.

6. Pro-rata entitlement based on commencement date. Appointed Company Secretary on 5 October 2015.

The payment of STIs is subject to Board approval. The Board has the discretion to adjust remuneration outcomes

higher or lower to prevent any inappropriate reward outcomes, including reducing (down to zero, if appropriate) any STI.

Variable remuneration - LTIs

The LTI component of the remuneration package is to reward executive directors, senior managers and other invited

employees of the Group in a manner which aligns a proportion of their remuneration package with the creation of

shareholder wealth over a longer period than the STI.

The Independence Group NL Employee Performance Rights Plan (PRP) was approved by shareholders at the Annual

General Meeting in November 2014. Under the PRP, participants are granted share rights for no consideration that will

only vest if certain performance conditions are met and the employees are still employed by the Group at the end of the

vesting period. Participation in the PRP is at the Board’s discretion and no individual has a contractual right to

participate in the plan or to receive any guaranteed benefits.

To FY16, the Managing Director has the opportunity to earn 100% of his TFR as an LTI. All other executives have the

opportunity to earn between 20-55% of their TFR as an LTI. From FY17, the LTI opportunity for the Managing Director

will reduce to 70% of TFR and the LTI opportunity for all other executives will be between 20-40% of TFR.

During the period 643,911 share rights were issued as FY16 LTIs to executive KMP and senior staff in accordance with

the PRP. Of this amount, 217,391 were issued to the Managing Director as approved by shareholders at the 2015

Annual General Meeting. The quantum of share rights is determined by the executive’s TFR; the applicable multiplier;

and the face value of the Company's shares, calculated as the 20 day volume weighted average price (VWAP).

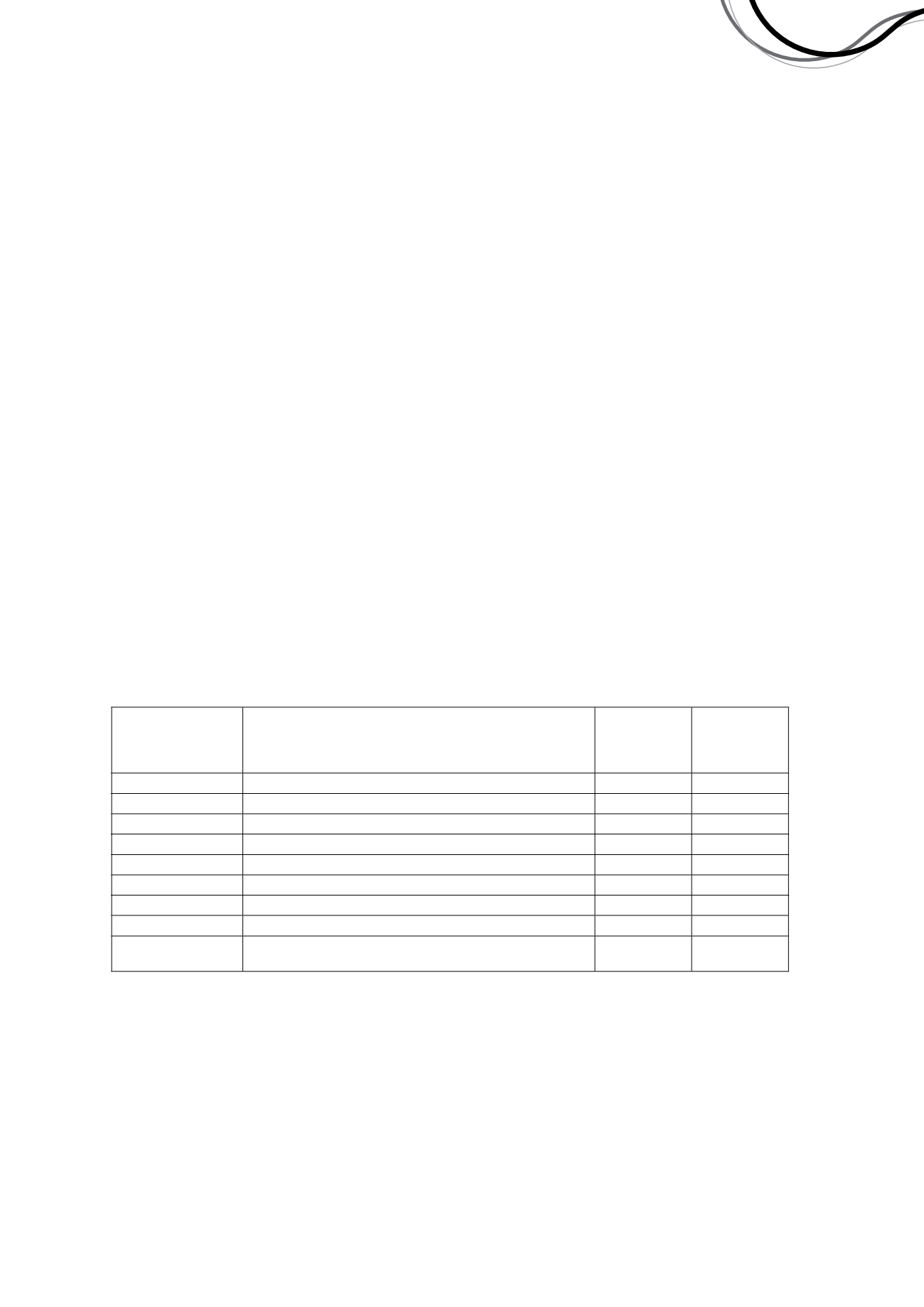

The following share rights were issued to executive KMP in relation to FY16:

Name

Position

Number of

share rights

issued for

FY15 period

1

Number of

share rights

issued for

FY16 period

2

Peter Bradford

Managing Director

175,365

217,391

Keith Ashby

Sustainability Manager

n/a

3

19,361

Rob Dennis

Chief Operating Officer

n/a

4

78,116

Matt Dusci

Chief Growth Officer

50,154

62,174

Joanne McDonald Company Secretary

n/a

5

10,586

6

Sam Retallack

Organisational Capability Manager

10,473

19,361

Scott Steinkrug

Chief Financial Officer

50,154

62,174

Brett Hartmann

General Manager, Operations (ceased 29 February 2016)

58,513

72,536

Tony Walsh

7

Company Secretary and General Manager, Corporate

(ceased 9 October 2015)

50,154

n/a

1. Share rights awarded at 20 day VWAP to 30 September 2014 of $4.28.

2. Share rights awarded at 20 day VWAP to 20 August 2015 of $3.45.

3. Not qualified as only appointed in April 2015.

4. Appointed KMP on 1 March 2016, prior to that held the role of General Manager, Project Development (from 22 September 2015)

and prior to that Chief Operating Officer of Sirius Resources NL.

5. Appointed 5 October 2015.

6. Pro-rata entitlement based on commencement date.

7. Ceased to be an employee on 9 October 2015. In accordance with the PRP all unvested share rights lapsed and were cancelled.

Independence Group NL

20