50 Independence Group NL

DIRECTORS’ REPORT

Directors' report

30 June 2016

(continued)

Remuneration report (continued)

2016 Executive remuneration (continued)

Variable remuneration - LTIs (continued)

The number of share rights able to be issued under the PRP is limited to 5% of the issued capital. The 5% limit includes

grants under all plans made in the previous five years (with certain exclusions under the

Corporations Act 2001).

This

percentage now stands at 1.1%. There are no voting or dividend rights attached to the share rights.

Share rights granted after 1 July 2014

Vesting of the share rights granted to executive KMP after 1 July 2014 is based on a continuous service condition and a

total shareholder return (TSR) scorecard.

Service condition

The service condition is met if employment with IGO is continuous for three years commencing on or around the grant

date. The condition is aimed at retaining key personnel.

The treatment of LTI awards of executives, whose employment ceases prior to vesting, depends on the reason for

cessation and is subject to Board discretion to determine otherwise. If, in the opinion of the Board, the executive acts

fraudulently or dishonestly, or is in material breach of his or her obligations to any Group entity, then the Board in its

absolute discretion may determine all the executive's unvested share rights will lapse and the Board's discretion will be

final and binding.

Performance condition

The TSR scorecard for the three year measurement period will be determined based on a percentile ranking of the

Company's TSR results relative to the TSR of each of the companies in the peer group over the same three year

measurement period. Reflecting on market practice, the Board considers that relative TSR is an appropriate

performance hurdle because it ensures that a proportion of each participant’s remuneration is linked to the return

received by shareholders from holding shares in a company over a particular period. There is no re-testing provision of

the TSR performance condition following the initial testing at the end of the three year measurement period.

The peer group is to comprise the constituents of the S&P ASX 300 Metals and Mining Index who are engaged in gold

and/or base metals mining in Australia and have the closest market capitalisation to the Company.

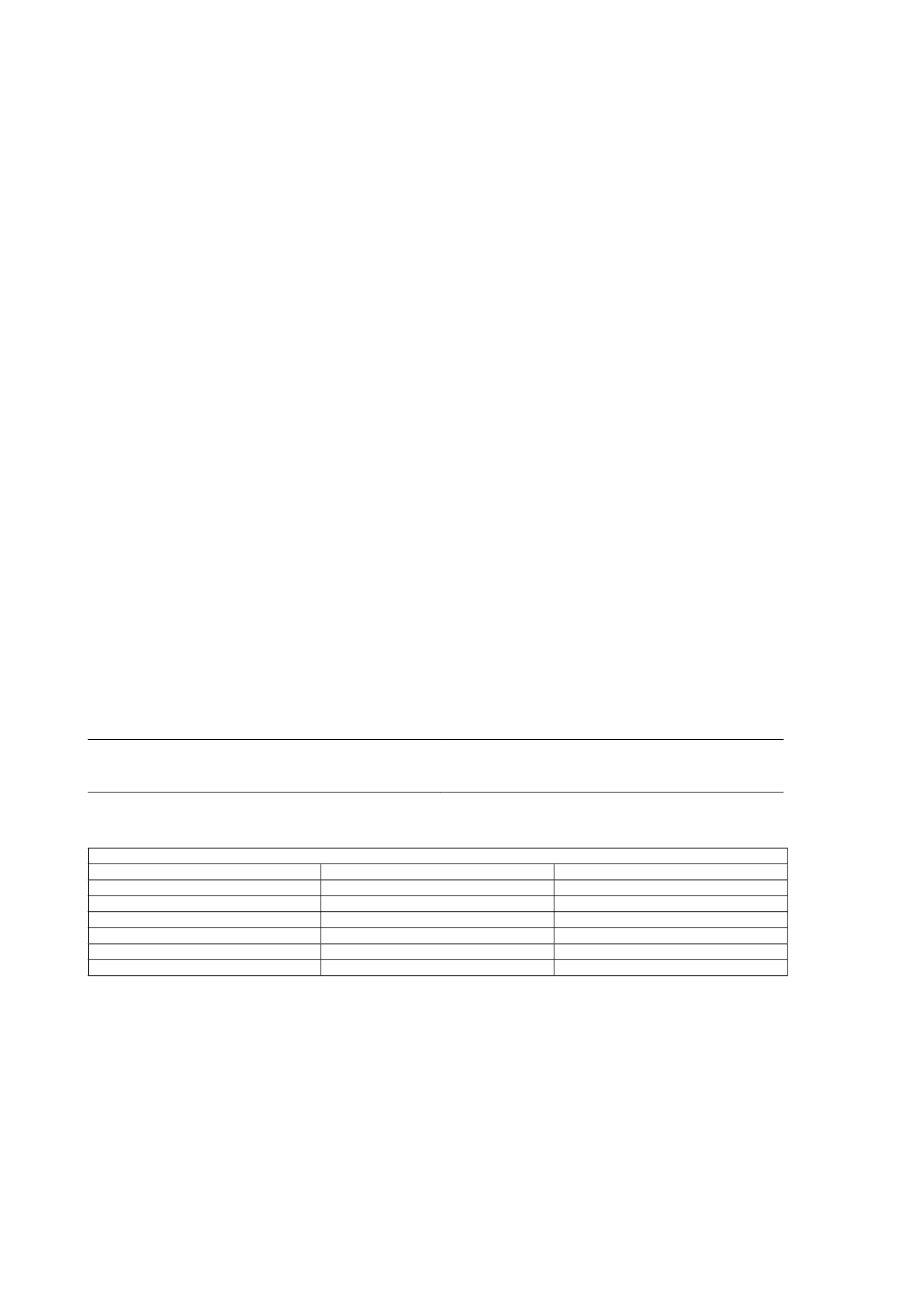

The vesting schedule of the share rights subject to relative TSR testing is as follows:

Relative TSR performance

Level of vesting

Less than 50th percentile

Zero

Between 50th and 75th percentile

Pro-rata straight line percentage between 50% and 100%

75th percentile or better

100%

The Company's TSR performance for share rights issued during FY16 will be assessed against the following 20 peer

group companies:

Peer Group

Aditya Birla Minerals Ltd

1

Alacer Gold Corp.

Beadell Resources Ltd

Cudeco Ltd

Evolution Mining Limited

Kingsgate Consolidated Limited

Medusa Mining Ltd

Metals X Limited

Mincor Resources NL

Northern Star Resources Limited

Oceana Gold Limited

Oz Minerals Ltd

Panoramic Resources Ltd

Perseus Mining Limited

Regis Resources Limited

Resolute Mining Limited

Saracen Mineral Holdings Limited Sandfire Resources Ltd

Silver Lake Resources Limited

Western Areas Ltd

1. To be removed from peer group of companies following takeover of the company.

Share trading policy

The trading of shares issued to participants under the PRP is subject to, and conditional upon, compliance with the

Company’s Dealing in Securities Standard. The Standard also prohibits all employees, including Directors and senior

management, from entering into any hedging arrangement over unvested securities issued pursuant to any share

scheme, performance rights plan or option plan.

Independence Group NL

21