Annual Report 2016 47

DIRECTORS’ REPORT

Directors' report

30 June 2016

(continued)

Remuneration report (continued)

2016 Executive remuneration (continued)

Fixed remuneration (continued)

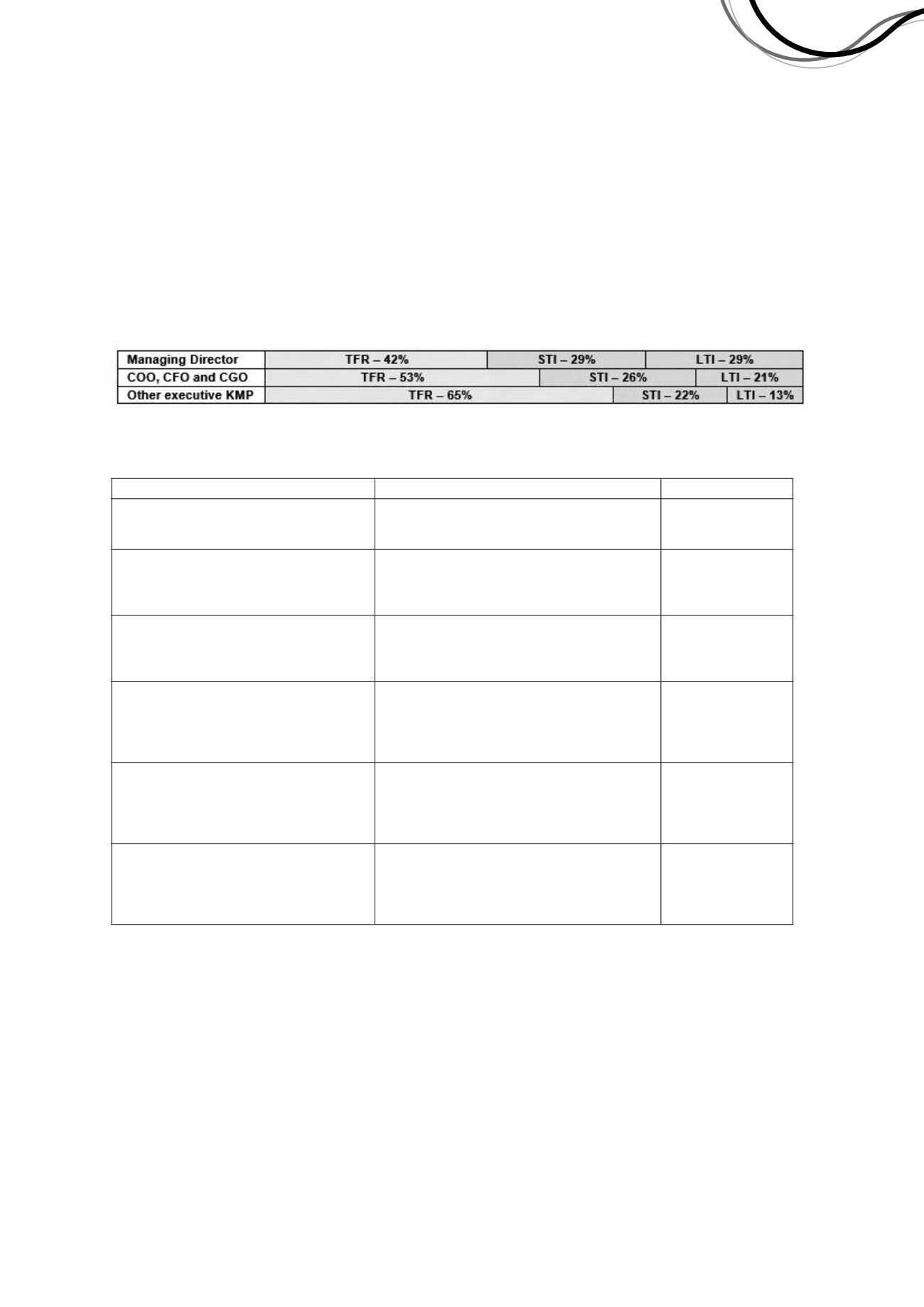

The mix of fixed and at-risk remuneration varies depending on the role and grading of executives, and also depends on

the performance of the Company and the individual.

If maximum at-risk remuneration were to be earned for FY17, the percentage of fixed to at-risk remuneration would be

as follows:

Variable remuneration - STIs

STIs paid in FY16 were for the performance by eligible executives in FY15. The following table indicates the

performance of KMP against FY15 KPIs:

Key Result Area

KPI Measure (in summary)*

Achievement

Sustainability (7.5%)

Assessed against improvement in LTIF and

TRIF, completion of external review of EMS and

SMS and preparation of Sustainability Report.

7.5%

People (7.5%)

Assessed against completion of Group

restructure to align with Company strategy and

implement vision and values across the

organisation.

7.5%

Quality and communication (5%)

Assessed against implementation of

standardised systems and processes across

the Company and incorporation of risk

management measures.

0%

Processes and outputs (15%)

Assessed against achievement of NPAT for

FY15, improvement of reporting time lines to

ASX and implementation and improvement of

internal reporting systems. Stretch target

achieved.

22.5%

Growth (15%)

Assessed against increase mine life at Jaguar

and Long, identifying advanced stage

exploration projects for acquisition and

completion of acquisition of a

producing/development stage asset.

12.5%

Individual KPIs/Personal performance

(50%)

Assessed against increase in mine life at

Jaguar and Long, identifying advanced stage

exploration projects for acquisition and

completion of acquisition of a

producing/development stage asset.

37.5 - 47.5%

* Due to the sensitive nature of some corporate KPIs the full detail on measures and achievement is confidential.

The following table indicates performance against FY16 KPIs (corporate and individual) which will be paid in September

2016:

Independence Group NL

18