Annual Report 2016 45

DIRECTORS’ REPORT

Directors' report

30 June 2016

(continued)

Remuneration report (continued)

Remuneration Committee (continued)

Use of remuneration consultants

From time to time, the Committee engages external remuneration consultants to ensure it is fully informed when making

remuneration decisions. During the year ended 30 June 2016 no remuneration recommendations, as defined by the

Corporations Act

, were provided by remuneration consultants. However, it did utilise data provided by AON Hewitt

McDonald ($5,030), Mercer Consulting ($4,500), Godfrey Remuneration Group ($4,000) and Ernst and Young ($5,100)

regarding salaries and benefits across the organisation.

Remuneration philosophy

The Board recognises that, as a mid-tier diversified mining company, there is an added complexity to the business that

depends upon the quality of its Directors and Executives. To ensure the Company continues to succeed and grow, it

must attract, motivate and retain highly skilled Directors and Executives.

The principles supporting the Company’s remuneration policy are that:

• remuneration arrangements are competitive and reasonable to attract and retain key talent;

• remuneration is linked to the Company’s strategic and business objectives and the creation of shareholder value;

and

• individual reward is based on performance against a range of appropriate targets relating to the delivery of and

execution of the Company’s strategic plan.

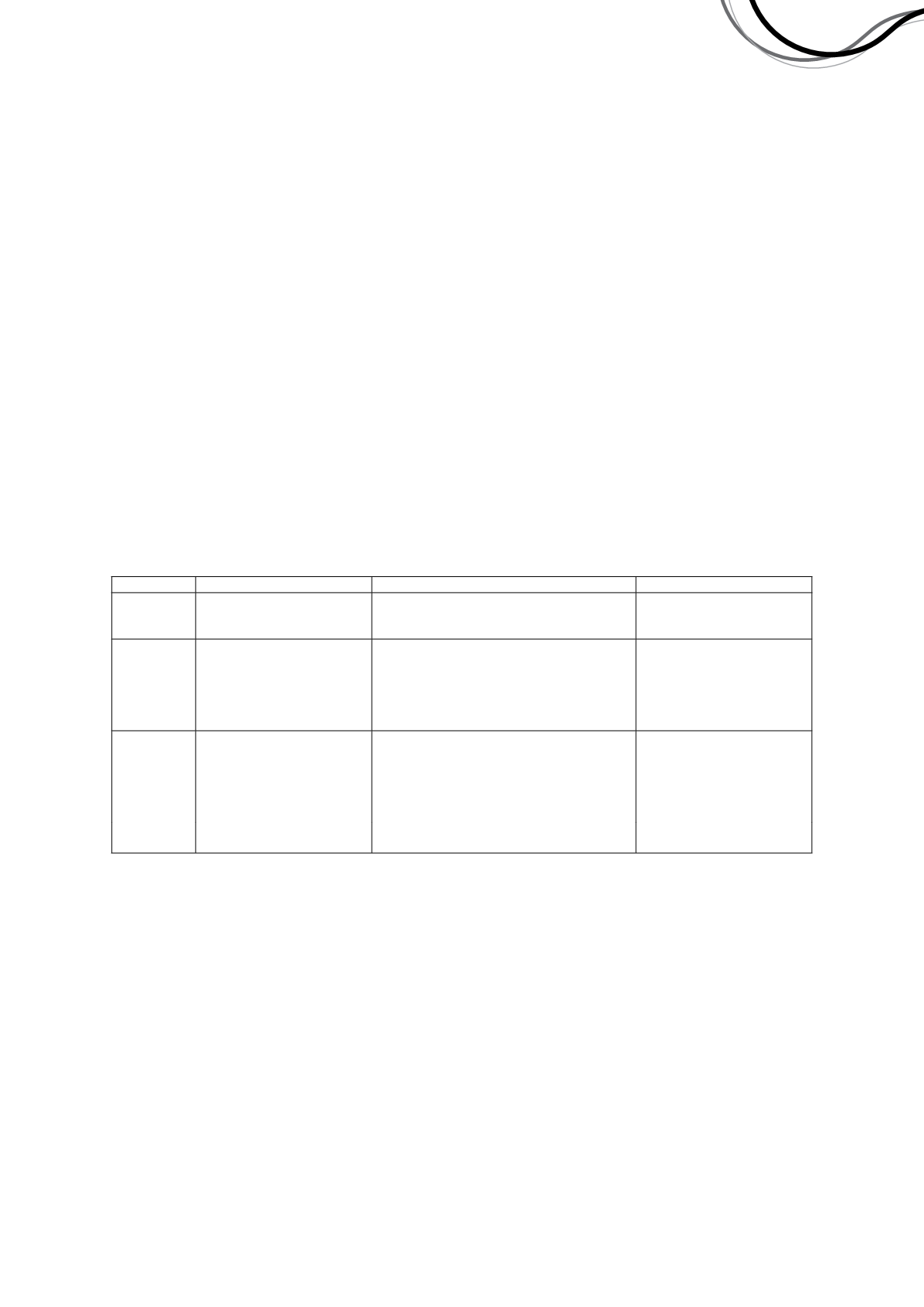

Remuneration components

Component Vehicle

Objective

Link to performance

Total fixed

remuneration

(TFR)

Base salary and

superannuation

contributions.

• To provide competitive fixed remuneration

with reference to role, market and

experience.

Annual performance of

individual and the Company.

STI

Cash payments targeted at a

percentage of TFR.

• To provide an ‘at risk’ incentive to reward

for current year performance which aims to

align individual’s performance with

achieving the overall strategic plan through

the achievement of annual performance

measures.

Combination of specific

Company KPIs and

Individual KPIs.

LTI

Performance rights based on

a percentage of TFR.

• To provide an ‘at risk’ grant to incentivise

and motivate executives to pursue the

long-term growth and success of the

Company which aligns to long-term

shareholder value and the Company’s

long-term strategic objectives.

Total Shareholder Return

percentile ranking over the 3

year performance period

relative to a selected peer

group.

• To support retention of executives and key

personnel.

Developments during FY16

Following extensive market research and the report prepared by Gerard Daniels in FY15 (as reported in the 2015

Annual Report) which examined the competitiveness of remuneration for Director's and executives employed by the

Company, on the recommendation of the Committee the Board approved:

• no increase to the Managing Director’s TFR for the second consecutive year;

• no general increase to executive TFR, except for instances of role change, for the second consecutive year;

• increase in potential STI award for the Managing Director from 40% to 50% of TFR;

• increase in potential STI award for executives from 15-25% to 30-40% of TFR; and

• no increase to Directors’ fees, however additional committee chairman fees were introduced (see page 55 for

details).

Independence Group NL

16