Annual Report 2016 65

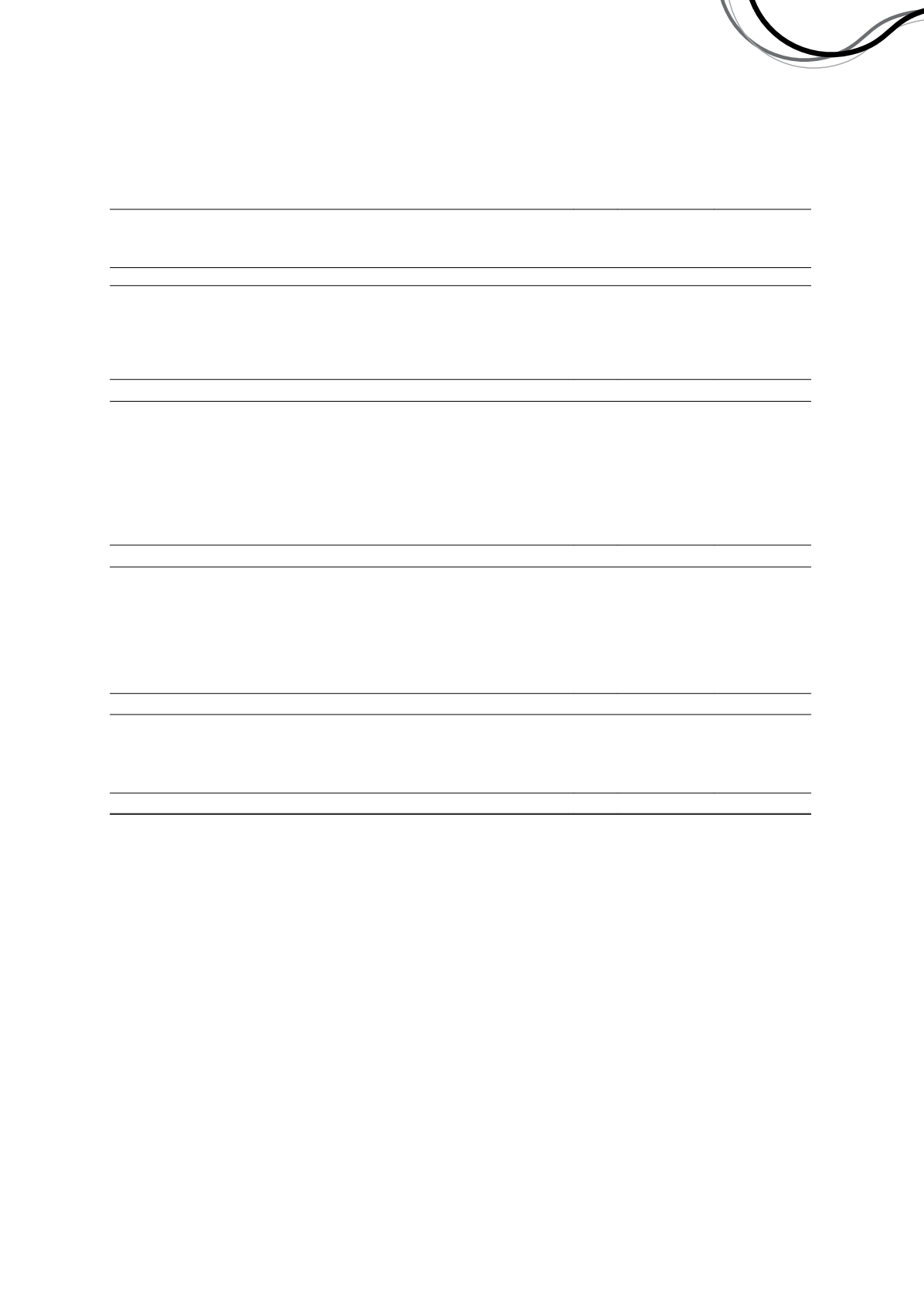

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 30 JUNE 2016

Consolidated statement of cash flows

For the year ended 30 June 2016

Notes

2016

$'000

2015

$'000

Cash flows from operating activities

Receipts from customers (inclusive of goods and services tax)

441,317

527,425

Payments to suppliers and employees (inclusive of goods and services tax)

(320,926)

(300,592)

120,391

226,833

Interest and other costs of finance paid

(6,915)

(1,054)

Interest received

1,587

1,351

Payments for exploration expenditure

(20,032)

(25,742)

Receipts from other operating activities

163

325

Net cash inflow from operating activities

95,194

201,713

Cash flows from investing activities

Payments for property, plant and equipment

(10,711)

(16,602)

Proceeds from sale of property, plant and equipment and other investments

16,961

336

Payments for purchase of listed investments

(1,605)

(13,085)

Payments for development expenditure

(215,489)

(44,118)

Payments for capitalised exploration and evaluation expenditure

(10,586)

(12,417)

Payment for acquisition of subsidiary, net of cash acquired

(202,052)

-

Net cash (outflow) from investing activities

(423,482)

(85,886)

Cash flows from financing activities

Proceeds from borrowings

271,000

-

Repayment of borrowings

-

(25,000)

Transaction costs associated with borrowings

(5,355)

(142)

Repayment of finance lease liabilities

(510)

(3,497)

Payment of dividends

19

(12,786)

(25,768)

Net cash inflow (outflow) from financing activities

252,349

(54,407)

Net (decrease) increase in cash and cash equivalents

(75,939)

61,420

Cash and cash equivalents at the beginning of the period

121,296

56,972

Effects of exchange rate changes on cash and cash equivalents

907

2,904

Cash and cash equivalents at the end of the period

7

46,264

121,296

The above consolidated statement of cash flows should be read in conjunction with the accompanying notes.

Independence Group NL

37