NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

70 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

1 Segment information (continued)

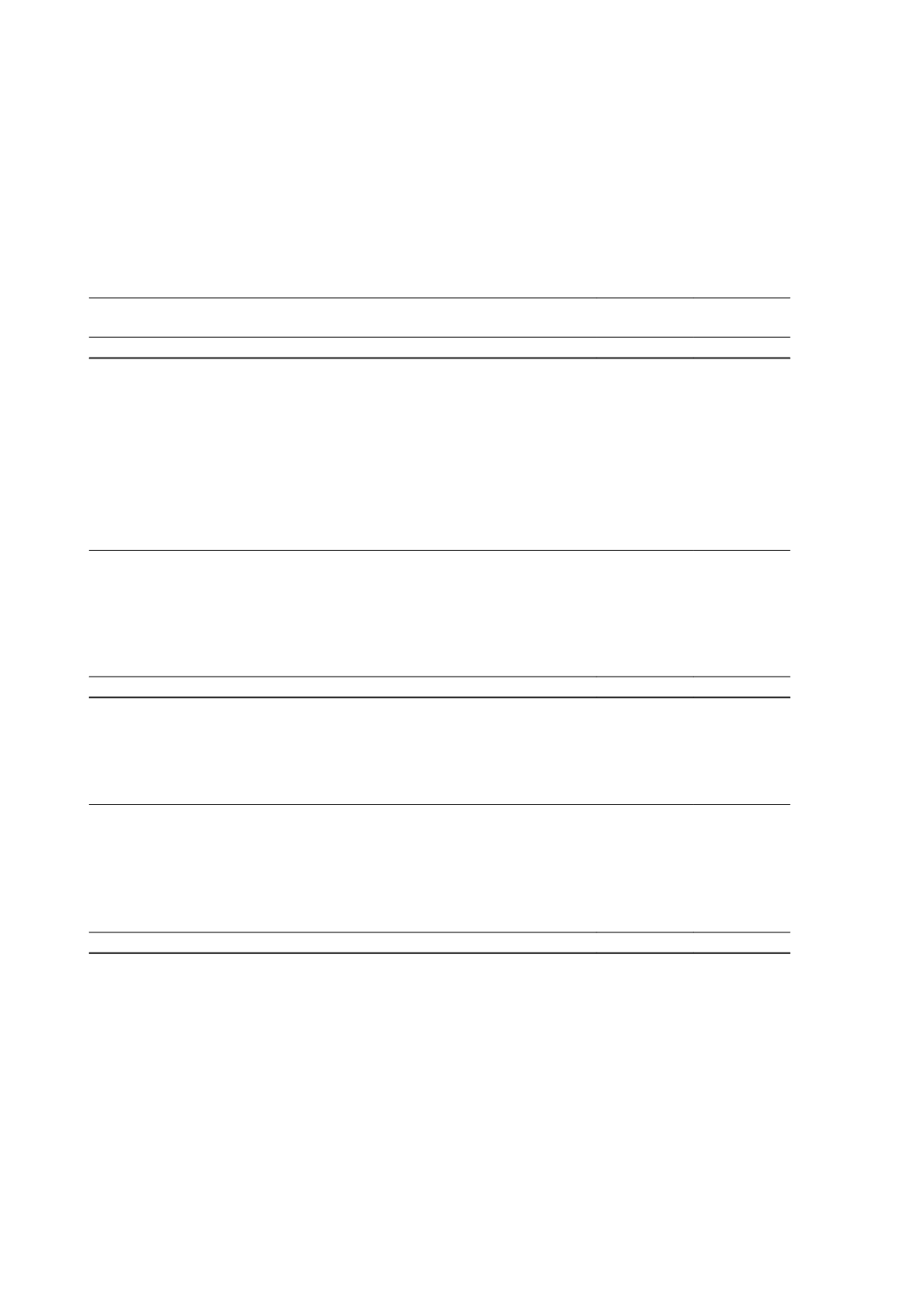

(c) Segment revenue

A reconciliation of reportable segment revenue to total revenue is as follows:

2016

$'000

2015

$'000

Revenue from external customers

411,941

494,433

Other revenue from continuing operations

1,247

893

Total revenue

413,188

495,326

Revenues for the Long Operation are all derived from a single customer, being BHP Billiton Nickel West Pty Ltd.

Revenues for the Jaguar Operation were derived from a single customer during the year.

Revenues for the Tropicana Operation were derived from various customers during the year.

(d) Segment net profit (loss) before income tax

A reconciliation of reportable segment net profit before income tax to net (loss) profit before income tax is as follows:

2016

$'000

2015

$'000

Segment net operating profit before income tax

20,514

123,298

Interest revenue on corporate cash balances and other unallocated revenue

1,247

893

Unrealised gains on financial assets

2,396

1,467

Share-based payments expense

(819)

(2,949)

Other corporate costs and unallocated other income

(17,349)

(11,363)

Borrowing and finance costs

(64)

(1,385)

Acquisition and other integration costs

(65,137)

-

Total net (loss) profit before tax

(59,212)

109,961

(e) Segment assets

A reconciliation of reportable segment assets to total assets is as follows:

2016

$'000

2015

$'000

Total assets for reportable segments

2,376,477

984,610

Intersegment eliminations

(616,812)

(389,508)

Unallocated assets:

Deferred tax assets

219,427

130,517

Listed equity securities

4,989

15,524

Cash and receivables held by the parent entity

18,967

75,812

Office and general plant and equipment

4,343

3,268

Total assets as per the balance sheet

2,007,391

820,223

Independence Group NL

42