NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

72 Independence Group NL

Notes to the consolidated financial statements

30 June 2016

(continued)

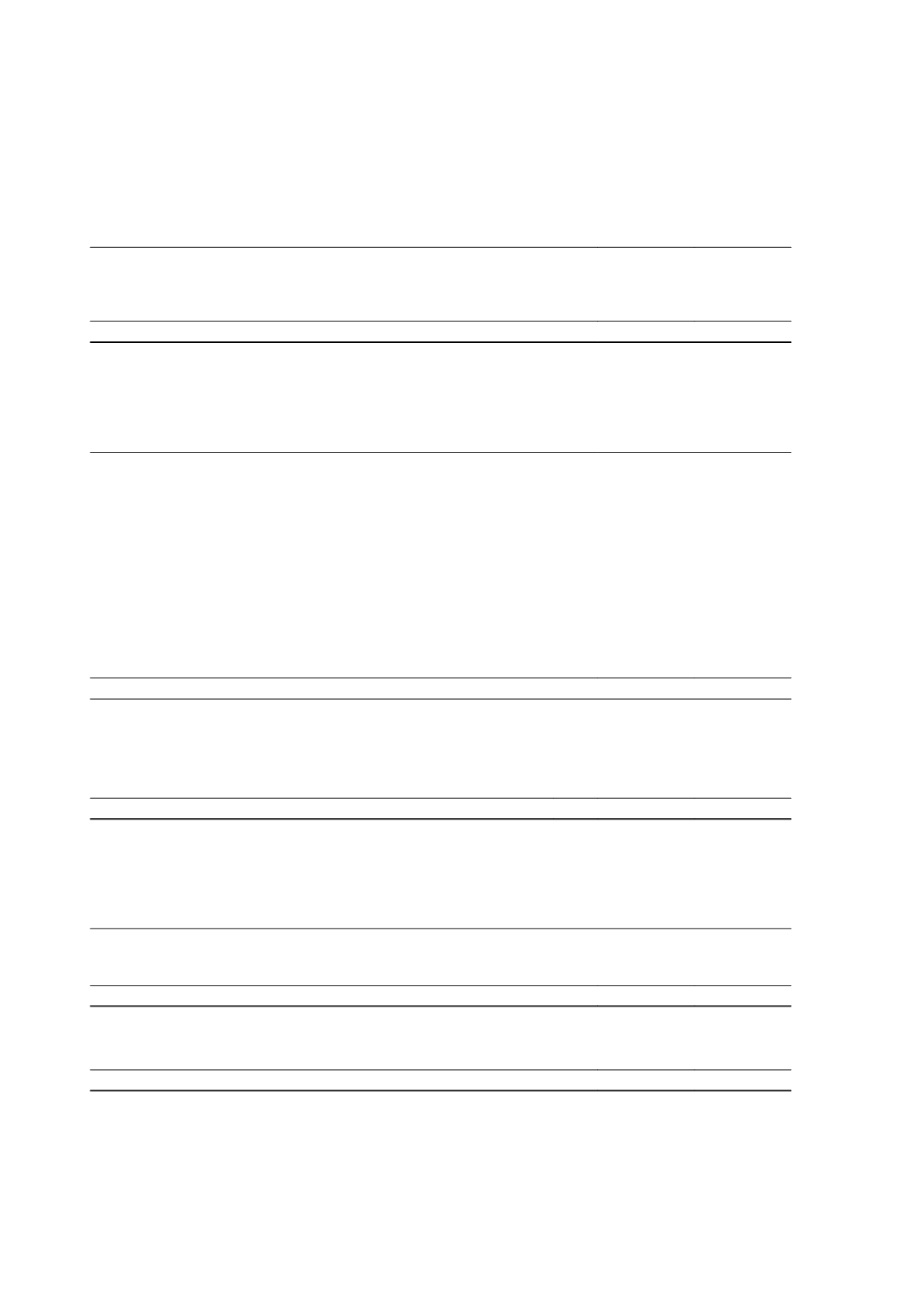

3 Other income

2016

$'000

2015

$'000

Net gain on disposal of property, plant and equipment

-

211

Net foreign exchange gains

907

2,892

Net gain on sale of investments

1,433

-

Net gain on disposal of tenements

1,522

165

3,862

3,268

4 Expenses and losses

2016

$'000

2015

$'000

Cost of sale of goods

233,880

239,745

Employee benefits expenses

66,975

63,841

Share-based payments expense

819

2,949

Exploration costs expensed

19,720

25,263

Rental expense relating to operating leases

1,473

1,273

Rehabilitation and restoration borrowing costs

707

590

Impairment of exploration and evaluation expenditure

35,518

3,461

Net loss of sale of property, plant and equipment

219

-

Amortisation expense

84,843

81,911

Depreciation

Depreciation expense

15,759

16,640

Less : amounts capitalised

(907)

-

Depreciation expensed

14,852

16,640

Borrowing and finance costs

Borrowing and finance costs - other entities

10,729

857

Amortisation of borrowing costs

402

709

Less: amounts capitalised

(11,055)

-

Finance costs expensed

76

1,566

5 Income tax

(a) Income tax expense

2016

$'000

2015

$'000

The major components of income tax expense are:

Deferred income tax expense

17,087

15,841

Current income tax (benefit) expense

(17,529)

17,341

Income tax (benefit) expense

(442)

33,182

Deferred income tax revenue (expense) included in income tax expense comprises:

(Increase) decrease in deferred tax assets

(25,141)

22,068

Increase in deferred tax liabilities

24,699

11,114

Income tax (benefit) expense

(442)

33,182

Independence Group NL

44