NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2016

Annual Report 2016 71

Notes to the consolidated financial statements

30 June 2016

(continued)

1 Segment information (continued)

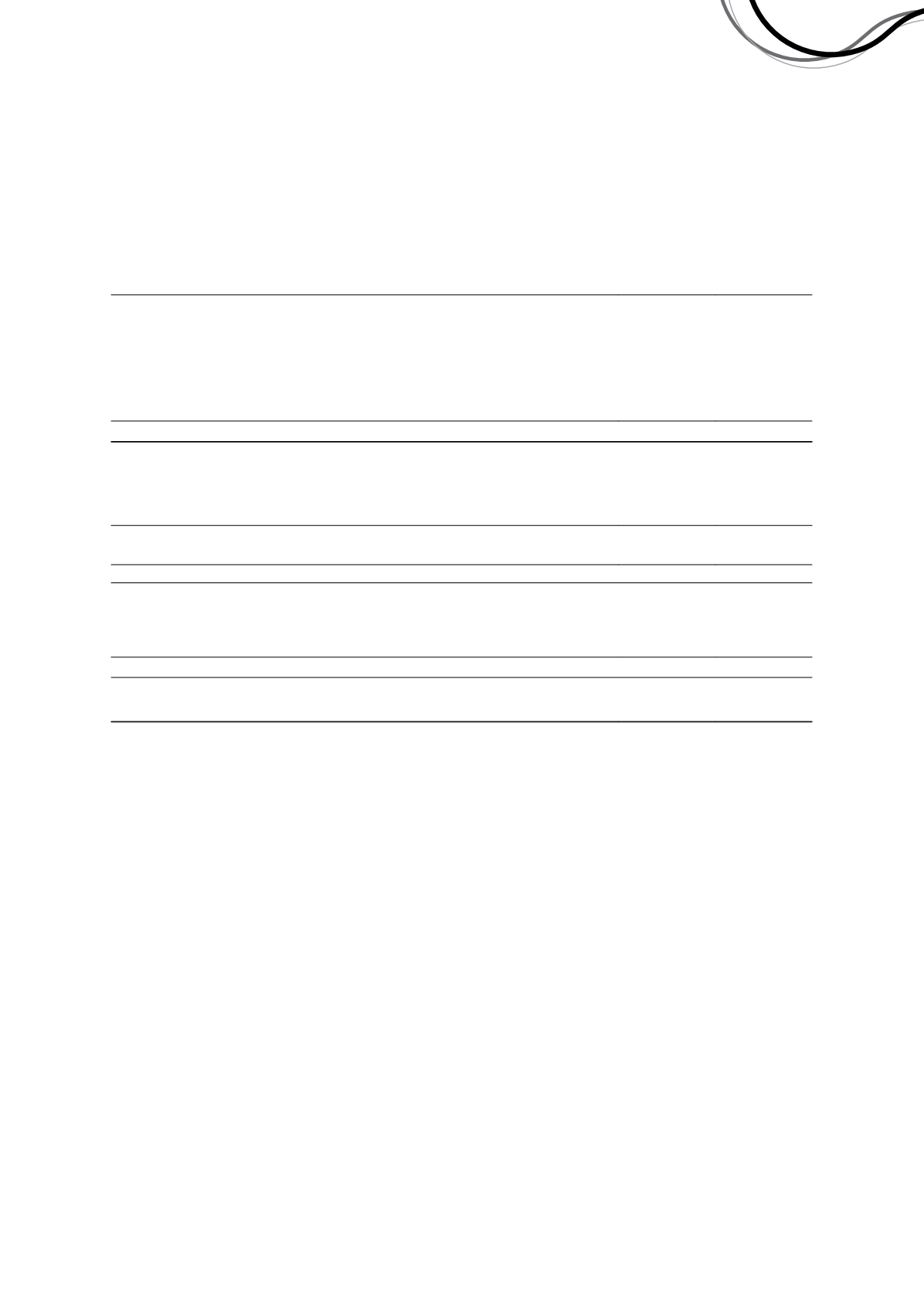

(f) Segment liabilities

A reconciliation of reportable segment liabilities to total liabilities is as follows:

2016

$'000

2015

$'000

Total liabilities for reportable segments

810,569

126,216

Intersegment eliminations

(690,382)

(55,005)

Unallocated liabilities:

Deferred tax liabilities

100,949

73,980

Creditors and accruals

63,358

8,225

Provision for employee entitlements

1,280

1,312

Bank loans

265,826

-

Total liabilities as per the balance sheet

551,600

154,728

2 Revenue

2016

$'000

2015

$'000

Sales revenue

Sale of goods

411,567

493,475

411,567

493,475

Other revenue

Interest revenue

1,458

1,396

Other revenue

163

455

1,621

1,851

Total revenue

413,188

495,326

(a) Recognition and measurement

Revenue is measured at the fair value of the consideration received or receivable to the extent that it is probable that

the economic benefits will flow to the Group and revenue can be reliably measured. The following specific recognition

criteria must also be met before revenue is recognised:

Sale of goods

Revenue from the sale of goods is recognised when there is persuasive evidence indicating that there has been a

transfer of risks and rewards to the customer.

Sales revenue comprises gross revenue earned, net of treatment and refining charges where applicable, from the

provision of product to customers, and includes hedging gains and losses. Sales are initially recognised at estimated

sales value when the product is sold. Adjustments are made for variations in metals price, assay, weight and currency

between the time of sale and the time of final settlement of sales proceeds.

Interest income

Interest income is recognised as interest accrues using the effective interest method. This is a method of calculating the

amortised cost of a financial asset and allocating the interest income over the relevant period using the effective interest

rate, which is the rate that exactly discounts estimated future cash receipts through the expected life of the financial

asset to the net carrying amount of the financial asset.

Independence Group NL

43